68 market research questions to ask (and how to ask them)

Example market research questions, market research questions to ask customers, market research questions for product development, market research questions for brand tracking, pricing survey questions for market research, how to write your own market research questions.

No two market research projects are alike, but happily there are some tried-and-tested questions you can use for inspiration to get the consumer insights you’re looking for.

It’s all about asking questions that are most relevant to the goals of your research. Every so often the best questions are actually quite straightforward, like asking consumers where they do their grocery shopping.

If you’re creating a customer profile, you’ll ask different questions than when you’re running creative testing with your target audience, or getting insights on key consumer trends in your market.

The right market research questions are the ones that will lead you to actionable insights, and give you a competitive advantage in your target market.

Let’s kick this off and get straight into some questions, shall we?

Where do we even begin with this?! There are so many types of research and we’ll get into which questions work for each below, but here are some classic example market research questions to get you started.

These particular questions are good for surveys that you might run when you’re running some essential consumer profiling research.

- Which of these products have you purchased in the last 3 months?

- Which of the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy at least once a month?

- Approximately, how much would you say you spend on >INSERT YOUR PRODUCT/SERVICE CATEGORY< per month?

- What is stopping you from buying more of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- When was the last time you tried a new >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Please rank the following on how important or unimportant they are when deciding which >INSERT PRODUCT CATEGORY< to buy?

- Which of these brands are you aware of?

- Which of these brands have you purchased from in the last 3 months?

- How do you prefer to shop for >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Why do you prefer to shop online?

- Why do you prefer to shop in-store?

- Thinking about the following, how often do you use/listen/watch each of these media?

- Where do you go to keep up to date with the news?

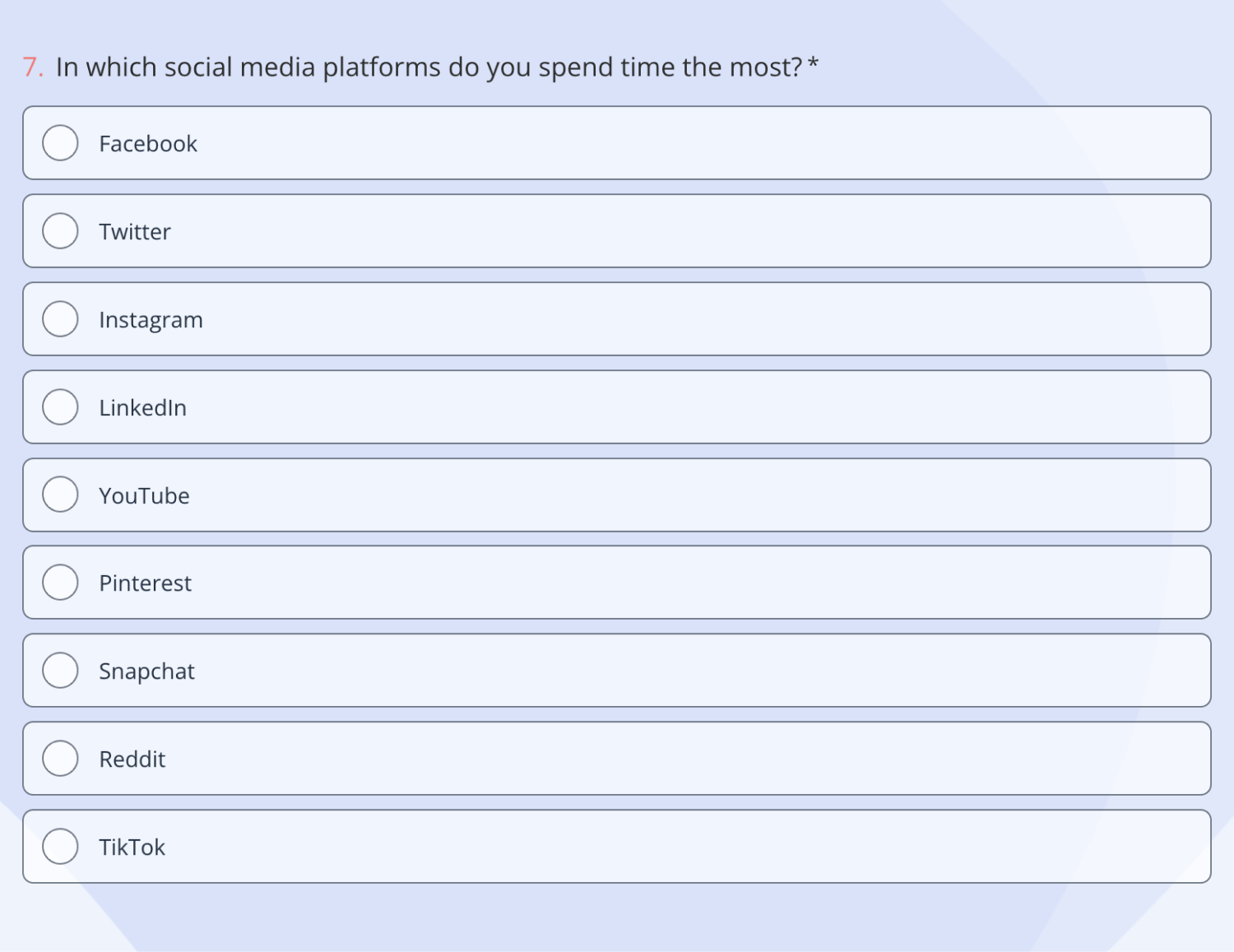

- Which social media platforms do you use daily?

- What mobile phone do you currently own?

Surely you want to talk to your current customers to understand why they buy from you and what they think about your products?

Correct! But your consumer research should definitely not end with current customers!

Here’s why you should think about broadening your research to include other groups and different market research methods :

- Current customers: This is a must! Running research to your current customers will help you understand how you can make your product or service better. These are the people who’ve spent their hard-earned cash on your products so they have a unique perspective on what kind of value you offer. In addition, understanding why your existing customer base chose your brand over others can help you create messaging that resonates with people who are still on the fence.

- Previous customers: People who used to buy your products but don’t anymore can give you valuable insight into areas you might need to improve. Perhaps your brand perception has shifted making some customers buy elsewhere, or maybe your competitors offer customers better value for money than you currently do. These are the kinds of areas you can learn about by running research to previous customers.

- Non-customers: You should also ask people who haven’t bought your products why they haven’t. That way you’ll learn what you need to improve to bring new customers in. You should ideally ask the same kinds of questions, so that you can learn about what product features you need to work on but also things like the messaging you should be putting out there to win people over.

Here are some questions that are perfect for competitive market analysis research. Some of these questions might sound similar to some from our previous section on consumer profiling—that’s because there’s often some crossover between these types of research. Consumer profiling often refers to a more general type of research that covers similar ground to market analysis. If you’re wondering how to calculate market size , questions like these would be a great starting point.

- How often do you usually purchase >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Why do you buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- What types of >INSERT YOUR PRODUCT/SERVICE CATEGORY< do you buy?

- How often do you buy the following types of >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you buy your >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Where do you find out about >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- Which of these brands have your purchased in the last 12 months?

- How would you feel if you could no longer buy >INSERT YOUR PRODUCT/SERVICE CATEGORY<?

- How important or unimportant do you find the following topics? (e.g. sustainability, diversity and inclusion, ethical supply chain)

- What could be improved about the products you currently use?

By involving consumers in the product development process, you can make sure that your products are designed to meet—and ideally exceed—their needs.

Product market research can be done at several points in the product development process, by asking potential customers in your target market questions about existing products (yours or competitors’), prototypes, or just your own early-stage product ideas.

You can dive into the customer experience, specific product features or simply find out if the product quality matches the value proposition you’re putting out there.

Sometimes you even get a surprising answer to the question: how does our product or service help people?

You might learn from the survey responses that customers are using your product in a different way than you intended, opening you up to new target markets and different product types in the future.

Asking these questions also allows you to get feedback on your designs, so that you can make necessary changes before the product is released. Here’s some inspiration for when you’re conducting product market research.

There are different types of new product development research. A key type is Jobs to be done research. This research digs into the practical reasons people buy products—the jobs they need to get done with a specific product. You use these insights to help you create products that will genuinely help consumers, and that they’ll ultimately want to buy.

- How many times have you carried out [INSERT ACTIVITY] in the last 12 months?

- How much time would you typically spend on this [INSERT ACTIVITY]?

- How important or unimportant is carrying out this [INSERT ACTIVITY]?

- How satisfied or unsatisfied do you feel when carrying out this [INSERT ACTIVITY]?

- What is the best thing about carrying out [INSERT ACTIVITY]?

- How does carrying out [INSERT ACTIVITY] make you feel? Please select all that apply

- What particular problems or challenges do you run into while carrying out [INSERT ACTIVITY]?

When you’re cooking up your brand’s next product, you’ll want to go through a concept testing phase. This is where you ask consumers what they think about your idea and find out whether it’s likely to be a success. Here are some of the questions you could ask in your concept testing research.

- To what extent do you like or dislike this idea/product? [ATTACH IMAGE]

- What do you like about this idea/product?

- What do you dislike about this idea/product?

- Is easy to use

- Sounds tasty

- Is good quality

- Is Innovative

- Is different from others

- Purchase this product

- Replace the product I currently own with this

- What other products this idea/product reminds you of? Please provide as much detail as possible including the product name.

- What feature(s), if any, do you feel are missing from this product?

- How would you improve this idea/product? Be as descriptive as possible!

- What issues do you solve through the use of this product?

- When can you see yourself using this product? Please select all that apply.

- The price for this product is $25.00 per item. How likely or unlikely would you be to buy this product at this price?

Get inspired with NPD survey templates

Our in-house research experts have created New Product Development (NPD) survey templates to give you the perfect starting point for your product research!

Does the perspective of new customers change over time? How do you compare to other brands, and how do you become the preferred brand in your market and increase that market share?

Brand perception and brand awareness are super important metrics to track. These insights can be used to improve customer experience and satisfaction on a higher level than just product: the relationship you have with your customers.

This research can also help you understand how to reach the holy grail of branding: turning loyal customers into brand ambassadors.

You should also remember to ask marketing research questions about your brand to existing and potential customers.

Existing customers might have a different view after having interacted with your team and products, and you can use that to manage the expectations of your target customers down the line. And potential customers can help you understand what’s holding them back from joining your customer base.

Top tip: it’s completely fine (and super beneficial!) to run brand tracking into your competitors’ brands as well as your own. Replicating research for different brands will give you a tailored benchmark for your category and position.

Here are some key questions to ask in your brand tracking research.

- Which of the following, if any, have you purchased in the past 12 months?

- Thinking about >INSERT YOUR CATEGORY<, what brands, if any, are you aware of? Please type in all that you can think of.

- Which of these brands of facial wipes, if any, are you aware of?

- Which of these facial wipe brands, if any, have you ever purchased?

- Which of these facial wipe brands, if any, would you consider purchasing in the next 6 months?

- e.g. Innovative

- Easy to use

- Traditional

- We’d now like to ask you some specific questions about >INSERT YOUR BRAND<.

- When did you last use >INSERT YOUR BRAND<?

- What do you like most about >INSERT YOUR BRAND<?

- What do you like least about >INSERT YOUR BRAND<?

- How likely would you be to recommend >INSERT YOUR BRAND< to a friend, family or colleague?

- Why did you give that score? Include as much detail as possible

- In newspapers/magazines

- On Instagram

- On Facebook

- On the radio

- Through friends/family/colleagues

- When did you last use >INSERT MAIN COMPETITOR BRAND<?

- How likely would you be to recommend >INSERT MAIN COMPETITOR BRAND< to a friend, family or colleague?

Kick off your brand tracking with templates

Track your brand to spot—and act on!—how your brand’s perception and awareness affects how people buy. Our survey templates give you the ideal starting point!

When it comes to pricing your product, there’s no need to wing it—a pricing survey can give you the insights you need to arrive at the perfect price point.

By asking customers questions about their willingness to pay for your product, you can get a realistic sense of what price point will be most attractive to them and, not unimportant, why.

Top tip: good pricing research can be tough to get right. Asking how much people would theoretically be willing to pay for a product is very different from them actually choosing it in a shop, on a shelf next to competitors’ products, and with a whole load of other economic context that you can’t possibly test for. Price testing is useful, but should sometimes be taken with a pinch of salt.

Here are some questions you could use in your pricing research.

- Which of the following product categories have you bought in the last 12 months?

- How often do you currently purchase >INSERT YOUR CATEGORY<?

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be starting to get expensive, so that it is not out of the question, but you have to give some thought to buying it? (e.g. Expensive)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be a bargain—a great buy for the money? (e.g. cheap)

- At what price would you consider this >INSERT PRODUCT CATEGORY< to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

- How much do you currently pay for >INSERT PRODUCT CATEGORY<? Please type in below

- Thinking about this product, please rank the following aspects based on how much value they add, where 1 = adds the most value 10 = adds the least value.

- Thinking about the product category as a whole, please rank the following brands in order of value, where 1 is the most expensive and 10 is the least.

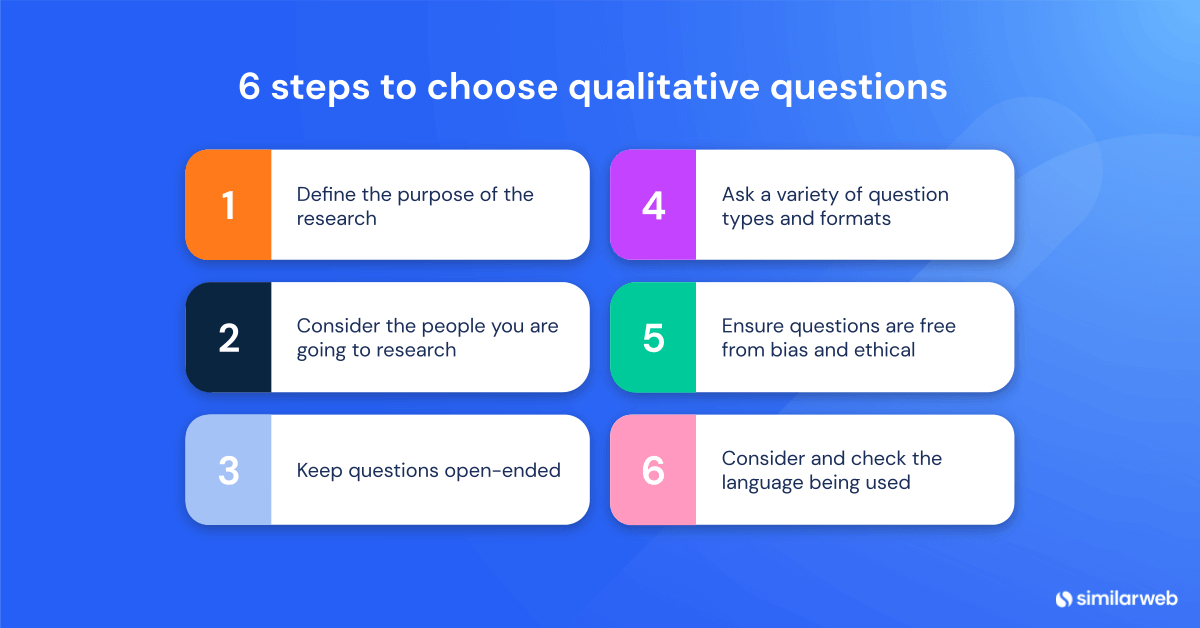

Formulating market research questions can be tricky. On the one hand, you want to be specific enough that you can get tangible, useful answers. But on the other hand, you don’t want to ask questions that are so difficult or unclear that respondents will get frustrated and give up halfway through.

Think about what answers you need and what actions you are hoping to take based on those answers.

We’ll help you get started with a list of steps to take when formulating your own market research questions, and putting them together in a survey that makes sense.

1. Define your research goals and link them to actions you can take

Before you can write great market research questions, you need to know what you want to learn from your research.

What are your goals? What do you want to find out? Once you have a clear understanding of your goals, you can start brainstorming questions that will help you achieve them.

2. Know your target market and the language they use

Who are you conducting market research for? It’s important to know your audience before you start writing questions, as this will help you determine the best way to phrase them.

For example, if you’re conducting market research for a new product aimed at teenagers, you’ll want to use different language than if you were conducting research for a new financial planning service aimed at retirees.

3. Keep it simple, and break things into smaller pieces

Don’t make your questions too complicated. Stick to simple, straightforward questions that can be easily understood by your target audience.

The more complex your questions are, the more likely it is that respondents will get confused and provide inaccurate answers.

If you feel a question is too difficult, see if you can break it up into smaller pieces and add follow-up questions on top.

And don’t ever load two questions into one! This falls into Consumer Research 101, but it’s amazing how often it happens. Instead of ‘What’s your favorite chocolate bar, and why?’ ask two questions: ‘What’s your favorite chocolate bar?’ and ‘Why is this your favorite chocolate bar?’

4. Be super specific

Make sure your questions are specific enough to get the information you need. Vague questions will only lead to vague answers.

For example, instead of asking ‘What do you think of this product?’, ask ‘What did you think of the taste of this product?’ or ‘What did you think of the packaging of this product?’.

5. Avoid leading questions

Leading questions are those that suggest a particular answer or course of action. For example, instead of asking ‘Do you like our new product?’, which suggests that the respondent should like the product, try asking ‘What are your thoughts on this product?

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction. It’s also brand-neutral: people answering this question will have no idea who’s asking, and their opinion won’t be biased as a result.

6. Make sure your question is clear

It’s important that your question is clear and concise so that respondents understand exactly what they’re being asked. If there is any ambiguity in your question, respondents may interpret it in different ways and provide inaccurate answers.

Always test your questions on a few people before sending them to a larger group to make sure they understand what they’re being asked.

7. Avoid loaded words

Loaded words are those with positive or negative connotations that could influence the way respondents answer the question. For example, instead of asking ‘Do you love this product?’, which has a positive connotation, try asking ‘What are your thoughts on this product?’

This question is neutral and allows the respondent to answer freely without feeling pressured in any particular direction

8. Make sure the question is answerable

Before you include a question in your market research survey, make sure it’s actually answerable. There’s no point in asking a question if there’s no way for respondents to answer it properly. If a question isn’t answerable, either revise the question or remove it from your survey altogether.

9. Use an appropriate question type

When designing your market research survey, be sure to use an appropriate question type for each question you include. Using the wrong question type can lead to inaccurate or unusable results, so it’s important to choose wisely. Some common question types used in market research surveys include multiple choice, rating scale, and open-ended questions.

10. Pay attention to question order

The order of the questions in your survey can also impact the results you get from your research. In general, it’s best to start with more general questions and then move on to more specific ones later on in the survey. This will help ensure that respondents are properly warmed up and able to provide detailed answers by the time they reach the end of the survey.

Make smart decisions with the reliable insights

To make sure you make smart decisions that have real impact on your business, get consumer insights you can rely on. Here’s our rundown of the top market research tools.

Survey questions for market research are designed to collect information about a target market or audience. They can be used to gather data about consumer preferences, opinions, and behavior. Some common types of market research survey questions include demographic questions, behavioral questions and attitudinal questions.

There are many different types of market research questions that companies can use to gather information about consumer preferences and buying habits. They can be divided into different categories, like a competitive analysis, customer satisfaction or market trends, after which you can make them more specific and turn them into survey questions. These are some of the things your research questions can help you answer: – What is the target market for our product? – Who is our competition? – What do consumers think of our product? – How often do consumers purchase our product? – What is the typical customer profile for our product? – What motivates consumers to purchase our product?

When conducting market research, surveys are an invaluable tool for gathering insights about your target audience. But how do you write a market research questionnaire that will get you the information you need? First, determine the purpose of your survey and who your target respondents are. This will help you to write questions that are relevant and targeted. Next, craft clear and concise questions that can be easily understood. Be sure to avoid ambiguity, leading questions and loaded language. Finally, pilot your survey with a small group of people to make sure that it is effective. With these tips in mind, you can write a market research survey that will help you to gather the crucial insights you need.

Elliot Barnard

Customer Research Lead

Elliot joined Attest in 2019 and has dedicated his career to working with brands carrying out market research. At Attest Elliot takes a leading role in the Customer Research Team, to support customers as they uncover insights and new areas for growth.

Related articles

5 beverage branding ideas (with examples you can learn from), survey vs questionnaire: what’s the difference and which should you use, what does inflation mean for brands, consumer profiling, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

- (855) 776-7763

All Products

BIGContacts CRM

Survey Maker

ProProfs.com

- Get Started Free

Want insights that improve experience & conversions?

Capture customer feedback to improve customer experience & grow conversions.

100+ Market Research Questions to Ask Your Customers

Babu Jayaram

Head of Customer Success - ProProfs

Review Board Member

Babu Jayaram brings over 20 years of experience in sales and customer service to his role on the Qualaroo Advisory Board. With a profound understanding of sales and conversion strategies, ... Read more

Babu Jayaram brings over 20 years of experience in sales and customer service to his role on the Qualaroo Advisory Board. With a profound understanding of sales and conversion strategies, Babu is committed to delivering exceptional results and fostering robust customer relationships. His expertise extends beyond mere management, including adept handling of support tickets, overseeing internal and customer-facing knowledge bases, and training support teams across diverse industries to ensure exceptional service delivery. Read less

Author & Editor at ProProfs

Shivani Dubey specializes in crafting engaging narratives and exploring Customer Experience Management intricacies. She writes on vital topics like customer feedback, emerging UX and CX trends, and sentiment analysis.

Asking the right market research questions can help you understand your target customers and map their behavior and preferences.

But what does it actually mean?

Let’s look at a sample from a market research survey report for mapping brand awareness:

From this simple Q&A report, you can:

- Visualize the proportions of demographic segments among your audience.

- Measure how your brand is performing in comparison to others.

- Pick the top preferred brand among the customers, explore what makes it stand out, and apply the same techniques to your brand.

- See how your target market perceives brand advertisements and promotional efforts.

Now imagine if this type of data set is available for different aspects of your business – product development, marketing campaigns, optimization plans, and more.

That’s what market research does for you.

With the evolution of customer interaction points and constantly changing market trends, more and more businesses are fueling efforts to do in-depth market research, as evidenced by the steady increase in the revenue of the market research industry worldwide.

Market research can help you develop essential business strategies and maintain a competitive advantage over other brands to increase conversions and customer base.

And it all starts with asking the right questions to the right audience.

That’s why we have created this collection of 100+ market research questions to ask your target market. Each question aims to uncover a specific attribute about your customers. You can use a combination of these customer research survey questions, interviews, and othe marketing questionnaires for customers.

We have also added key tips to help you write your own effective market analysis questions if the needed.

100+ Great Market Research Questions to Ask Your Customers

The main challenge while designing and conducting research is – “What questions should I ask in my customer research survey?

That’s why we have a carefully curated list of market research questions to help you get started.

To Explore New Product Opportunities

- What was your first reaction to the product?

- Would you purchase this product if it were available today?

- What feature would you like to see on the website/product?

- Which feature do you think will help improve the product experience for you?

- Of these four options, what’s the next thing you think we should build?

- What’s the one feature we can add that would make our product indispensable for you?

- Would implementing [this feature] increase the usability of the [product name]?

- Please let us know how we can further improve this feature.

- What problem would you like to solve with our product?

To Collect Feedback on Existing Products

- Have you heard of [product name or category] before?

- How would you feel if [product name] was no longer available?

- How disappointed would you be if you could no longer use [Product/feature name?]

- How often do you use [product name]?

- How long have you been using [product name] for?

- When was the last time you used [product name]?

- Please rate the following product features according to their importance to you.

- According to you, In which area is this product/service lacking the most? Specify below.

- How does the product run after the update?

- Rate our product based on the following aspects:

- Have you faced any problems with the product? Specify below.

- What feature did you expect but not find?

- How are you planning to use [product or service]?

- How satisfied are you with the product?

To Segment the Target Market

Please specify your age.

- Please specify your gender.

- Select your highest level of education.

- What is your current occupation?

- What is your monthly household income?

- What is your current marital status?

- What is the name of your company?

- Where is your company’s headquarters located?

- Please specify the number of employees that work in your company.

- What is your job title?

- In which location do you work?

- Which activity do you prefer in your free time?

- Which other physical activities do you take part in?

- Where is your dream holiday destination?

- Please rate the following as per their priority in your life – Family, work, and social life?

- Are you happy with your current work-life balance?

- Do you describe yourself as an optimist or a pessimist?

- How often do you give to charity?

- How do you travel to work?

- How do you do your Holiday shopping?

To Conduct a Competition Analysis

- Which product/service would you consider as an alternative to ours?

- Rate our competitor based on the following:

- Have you seen any website/product/app with a similar feature?

- How would you compare our products to our competitors?

- Why did you choose to use our [product] over other options?

- Compared to our competitors, is our product quality better, worse, or about the same?

- Which other options did you consider before choosing [product name]?

- Please list the top three things that persuaded you to use us rather than a competitor.

- According to you, which brand best fits each of the following traits.

To Gauge Brand Awareness

- [Your brand name] Have you heard of the brand before?

- How do you feel about this brand?

- How did you hear about us?

- Describe [brand name] in one sentence.

- If yes, please tell us what you like the most about [your brand name]?

- If no, please specify the reason.

- How likely are you to purchase a product from this company again?

- If yes, where have you seen or heard about our brand recently? (Select all that apply)

- Do you currently use the product of this brand?

- Have you purchased from this brand before?

- Of all the brands offering similar products, which do you feel is the best brand?

- Please specify what makes it the best brand for you in the category.

- Which of the following products have you tried? (Select all that apply)

- On a scale of 1 to 10, how likely would you recommend this brand to a friend or colleague?

To Map Customers’ Preferences

- Have you ever boycotted a brand? If so, which brand and why?

- What influences your purchase decision more – price or quality of the item?

- How many hours do you spend on social media like Facebook, Instagram, etc.?

- How do you do your monthly grocery shopping – online or through outlets?

- How do you search for the products you want to buy?

- Rate the factors that affect your buying decision for [product].

- What persuaded you to purchase from us?

- How likely are you to purchase a product from us again?

- Please rate the following aspects of our product based on their importance to you.

- What is the most important value our product offers to you?

- Which of the following features do you use least?

- How well does the product meet your needs?

To Map Customers’ Reservations

- Is there anything preventing you from purchasing at this point?

- What’s preventing you from starting a trial?

- Do you have any questions before you complete your purchase?

- What is the main reason you’re canceling your account?

- What are your main reasons for leaving?

- What was your biggest fear or concern about purchasing from us?

- What is the problem that the product/service helped to solve for you?

- What problems did you encounter while using our [product]?

- How easy did we make it to solve your problem?

- What is your greatest concern about [product]?

- Have you started using other similar products? If yes, what made you choose that product?

To Perform Pricing Analysis

- Would you purchase the product at [price]

- According to you, what should be the ideal price of the [product name]?

- Is our product pricing clear?

- According to you, what is the ideal price range for the product?

To Collect Feedback on Website Copy

- Please rate the website based on the following aspects:

- How well does the website meet your needs?

- Was the information easy to find?

- Was the information clearly presented?

- What other information should we provide on our website?

- How can we make the site easier to use?

- What could we do to make this site more useful?

- Is there anything on this site that doesn’t work the way you expected it to?

- How easy was it to find the information you were looking for?

- Have feedback or an idea? Leave it here!

- Help us make the product better. Please leave your feedback.

To Assess Website/Product Usability

- Are you satisfied with the website layout?

- What features do you think are missing on our website?

- What features do you not like on our website?

- Was our website navigation simple and user-friendly?

- How much time did it take to find what you were looking for on our website?

- Was it easy to find the products you are looking for?

- Was the payment process convenient?

To Uncover Market Trends and Industry Insights

- Did you purchase our product out of peer influence or individual preference?

- How do you form your opinion about our product?

- Do you follow trends of the product, or do you prefer to go with what you know?

- Do discounts or incentives impact your decision-making process?

Market Research Survey Templates

One of the easiest ways to conduct market research is to use survey templates. They can help you save time and effort in creating your own market research surveys.

There are many types of market research survey templates available, depending on your objectives and target audience. Some of the most popular ones are:

- Demographic Templates: These templates help you segment your customers based on their location. It can help you tailor your marketing strategies and offers to different customer groups.

- Consumer Behavior Templates: These templates help you keep your pulse on your target market.

Industry Insights Templates: These templates help you get detailed information about your target industry and business.

Breakdown of Different Market Research Questions

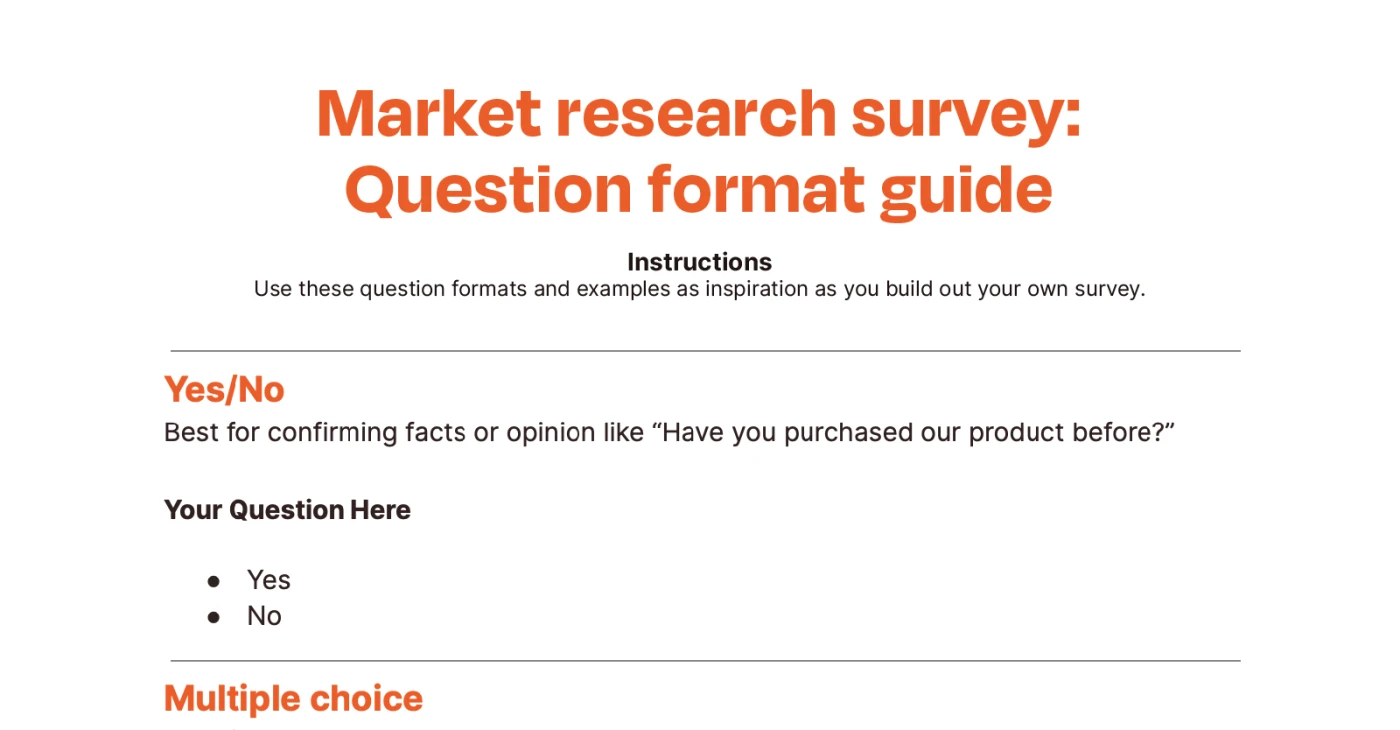

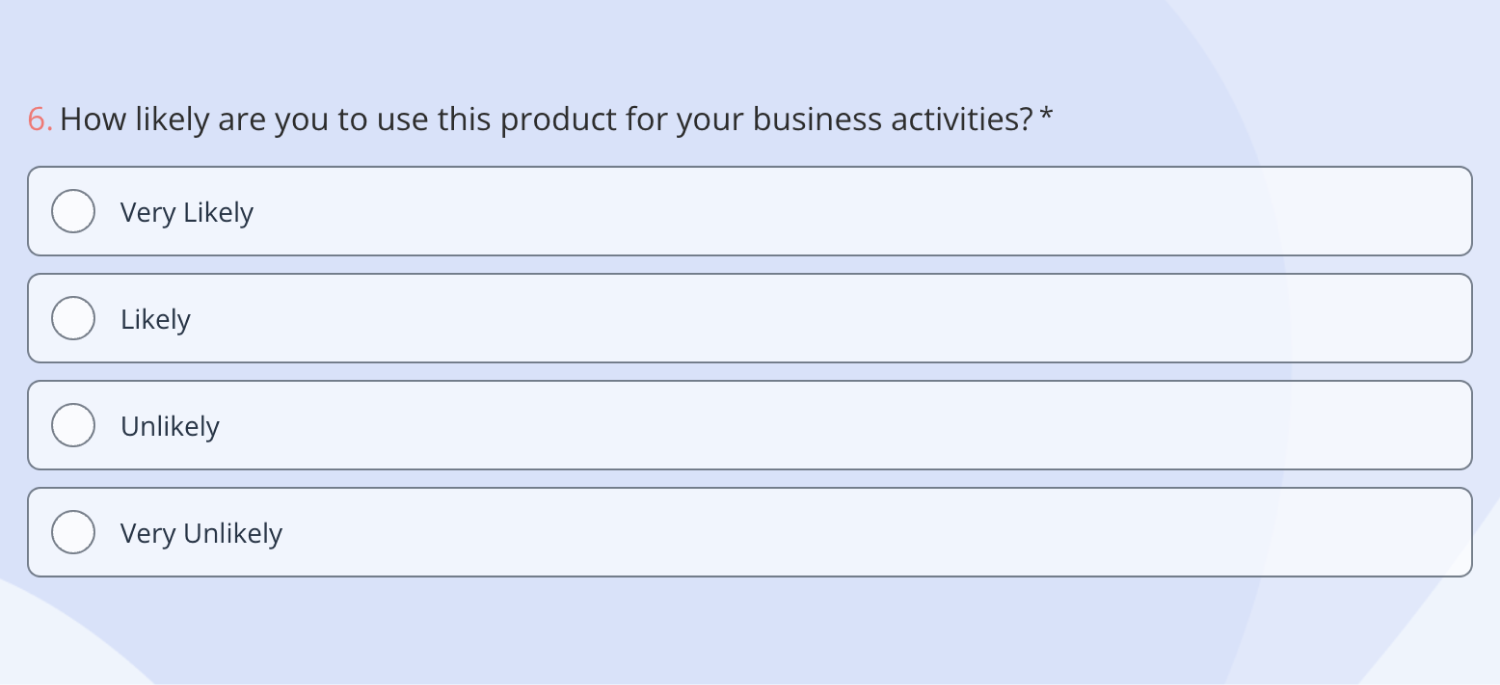

The answer choices in a market research survey question can significantly impact the quality and reliability of the response data you collect from the audience.

Some answer types help categorize the audience, while others measure their satisfaction or agreement.

So, before listing the customer research survey questions to ask your target audience, let’s understand their types:

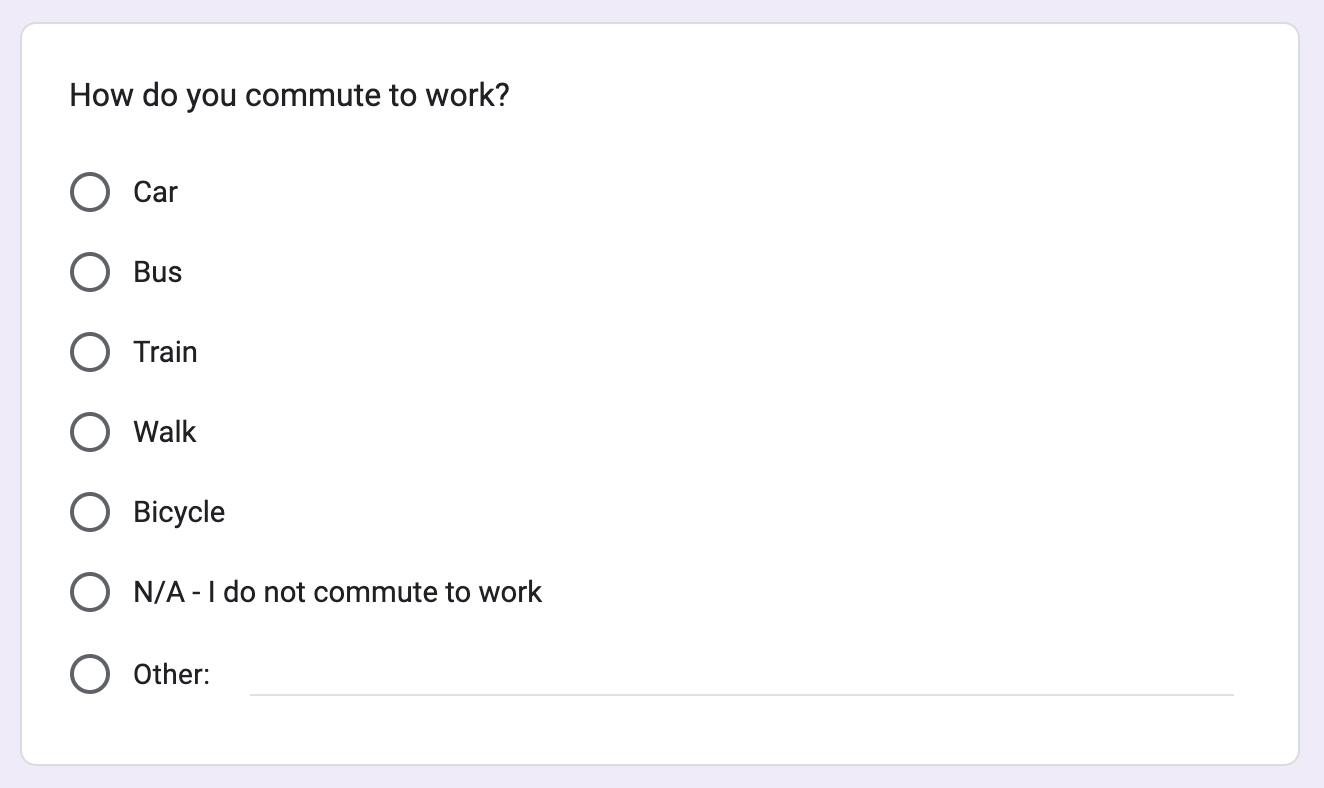

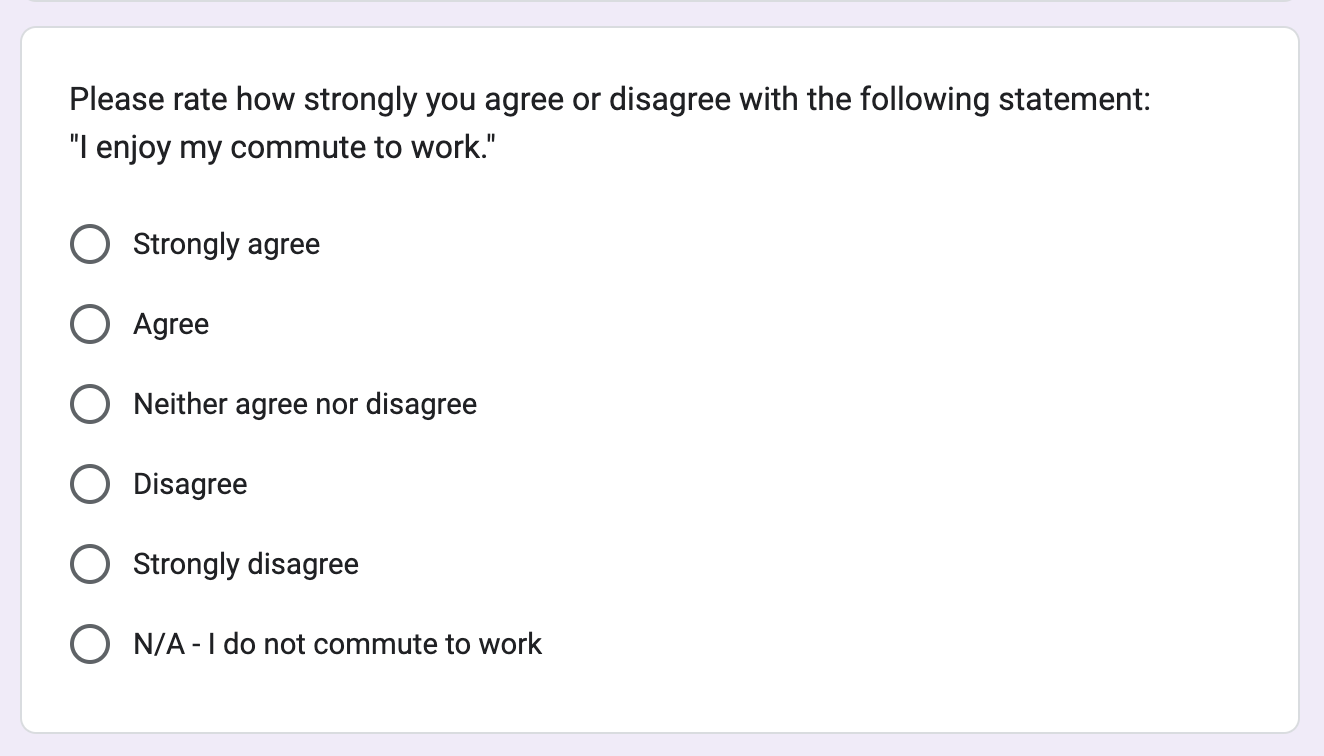

Multiple Choice

A multiple-choice question type lets users select more than one answer from the given options. These questions are great for collecting multiple data sets using the same question and gauging people’s preferences, opinions, and suggestions .

Single Choice

In a single-choice question, the respondent can select only one answer from the given options. This question type is great for:

- Segregating the users.

- Prioritizing product updates based on user consensus.

- Disqualifying irrelevant respondents by placing the question at the start of your customer research survey.

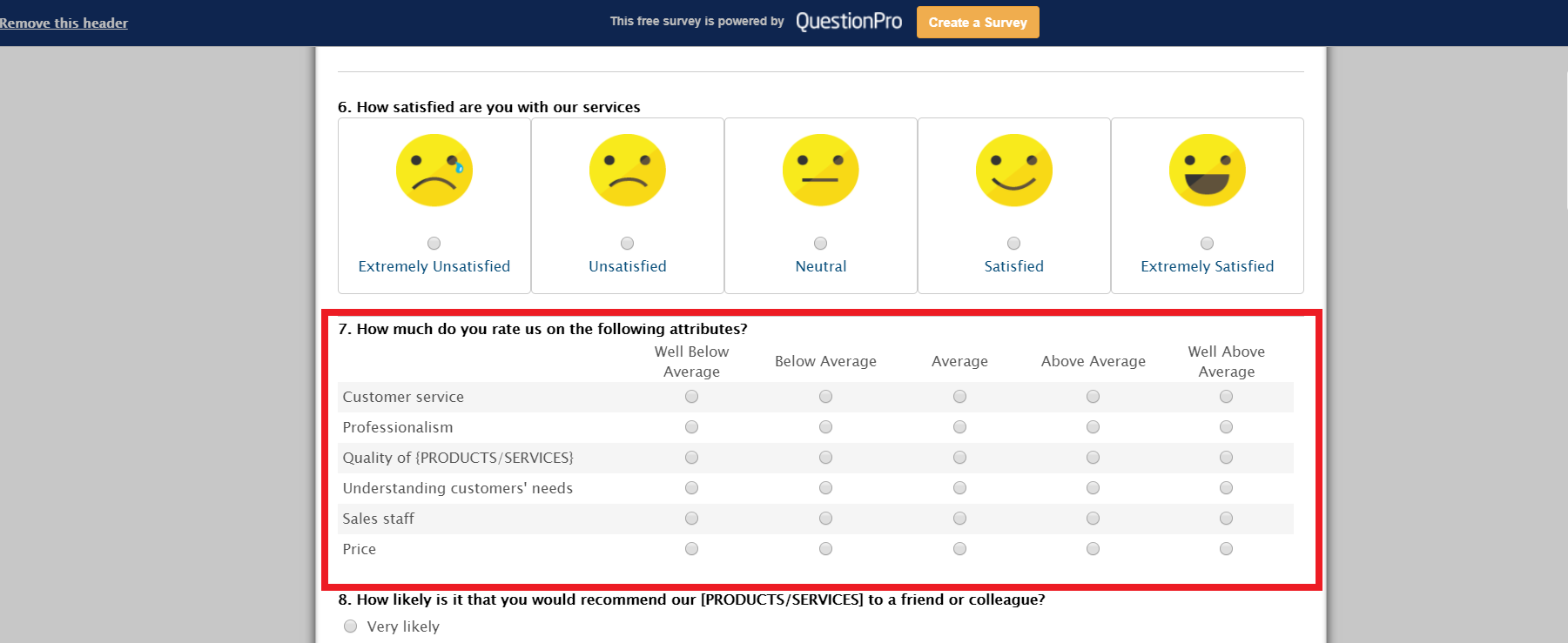

Matrix Match

A matrix matching grid can combine multiple market research questions into one to make the survey shorter . There is only one condition – the individual questions should have the same response anchors as shown in the image below:

The questions are arranged in rows while the answer options occupy the grid columns.

Ranking Question

A ranking question can help map customers’ preferences and set priorities for product development . This question type asks the respondent to arrange the given options in their decreasing/increasing preference.

Dichotomous

A dichotomous question poses a simple yes or no scenario to the respondent. These question types can help disqualify irrelevant people from the survey and categorize the users into two groups .

Likert Scale

Likert scale market research questions can help you measure the extent of respondents’ agreement/disagreement with the given statement . The answer options are arranged from positive to negative sentiments or vice-versa, with the neutral option in the middle.

There are two types of Likert scales: 5-point and 7-point .

Open-ended market questions let you explore the respondents’ minds without adding any restrictions to the answer . This question type is followed by a blank space for the respondent to add a free-text response.

You can add an open-ended question as a follow-up after the first question to explore the reasons for the customer’s previous answer. It also lets you collect more in-depth information about their issues, pain points, and delights.

Tools like Qualaroo offer tons of different question types for your surveys. Just pick the question and match its answer option type from the drop-down. To make it more effective, you can add branching to the survey.

How to Write Your Marketing Research Questions

It’s imperative to have a dedicated repository of market research questions for your surveys. But nothing’s better than crafting your questions.

For this, you need to sit with your team and discuss what information you require from the customers. It lets you analyze and document how much data you already have in your system, which can help set the market research scope.

We have listed some questions you need to ask yourself before asking market research questions to your potential customers or target market:

Audience Segmentation Questions

Audience segmentation questions help to size up your target market and provide a granular view of the audience . Not all customers are equal, and audience segmentation makes it possible to focus on each group individually to address their issues, fears, and expectations.

Here’s what you need to know before you start writing customer research survey questions to understand your audience:

- Do we understand the demographics of the new market we are trying to target? (Age, location, ethnicity, education, company, annual income, etc.)

- What are the locations that drive the most customers to our business? How are these locations different from others?

- What are the interests, preferences, and fears of people from our new target market? Have we addressed these situations for our current customer base?

- What are the psychographics attributes of the current customers and potential market? Are we targeting these in our campaigns?

- What are the most popular engagement channels for our customers? Which channels drive the most traffic to our website?

- Do we have enough data to perform value segmentation to separate high-value customers from low-value customers?

- How often do these high-value customers make a purchase?

Product-Based Market Research Questions

Product-based market research questions can produce precious insights to channel into your product development and optimization strategies . You can see how changing technology affects customers’ behavior, what new features they want to see in your product, and how they perceive your products and services over the competition.

Start by gathering information about the following:

- How does our product compare to the competition based on the features?

- What products do our competitors offer?

- What new features do customers want to see in our products? Do we have a product roadmap to deliver these updates?

- What unique solutions do our products offer? What is the value proposition that reflects this offering?

- Does our product incorporate the latest technological advancements?

- What channels do we use to collect product feedback from our users?

- What are customers’ preferences while choosing our products over competitors?

Pricing Market Research Questions

Pricing analysis can help you make your product more affordable to different customer segments while maintaining the desired gross margin. It also lets you restructure the pricing tiers to provide features depending on the customers’ requirements and company size .

Watch: (1/5) Supercharge Your Revenue With Data-Driven Pricing

Your sales and marketing team can help you hone in on the market research questions to ask your customers for running pricing analysis:

- Do the customers ever complain about the difficulty in finding the pricing information?

- What is the pricing structure of our competitors for the same products? What features do they include for a specific price?

- How do customers find our pricing when compared to the competitors?

- Do our products provide value for money to the customers? Does the sales pitch reflect this point?

- Can we restructure the pricing, and how will it affect the revenue?

- Are there any customer segments that have high-value potential but find the current pricing unaffordable? What are the plans for such customers?

- Are we in a situation to offer a basic free plan to encourage customers to try our product before upgrading?

- What promotions can we run to attract more customers?

- Should we target customers based on income, company size, or type of solution to set our product prices?

Brand Reputation Market Research Questions

A brand reputation questionnaire for marketing research gives you information on how well your target market knows about your brand. You can uncover previously unidentified channels to increase brand awareness and find potential customers to promote your brand .

Start by gauging what customers are saying about your brand:

- Which channels receive mentions of our brand? Are these posts positive or negative?

- Do we have a system in place to analyze and monitor these reviews and posts?

- What are the reviews of our brand on different sites? What is the overall impression of our brand in the market?

- How are we currently addressing the negative reviews and complaints? What do our customers think about the handling process?

- What is the impression of our brand in our target market?

- What brand awareness campaigns are our competitors running?

- Is our brand among the top choices of our target customers?

Advertisement & Campaign-Based Questions

These customer research survey questions let you assess the effectiveness of your current value propositions and campaigns . You can channel the customer insights into your advertising strategies to design targeted campaigns for different customer segments to reduce the overall acquisition cost and increase conversions.

Ask the following questions to collect information about the different marketing campaigns that are performing:

- What are the best modes to run the advertisement campaigns to reach our target audience?

- What is the estimated lifetime value of customers acquired from current campaigns? Is it higher or lower than the acquisition costs?

- Which campaigns bring the most ROI and why?

- How well do our advertisements present our value proposition to the customers? Do they address customers’ fears and expectations to attract them?

- Are we running A/B tests to improve our online campaigns? How are we gathering data to build the A/B test hypotheses – surveys, heatmaps, eye tracking, etc.?

- What advertisement campaigns do our competitors run?

7 Question Types to Use in Market Research Surveys

We mentioned earlier that market research questions provide important data for different operations like product development, marketing campaigns, sales pipeline and more.

But to what extent?

Let’s break it down to individual processes and understand how insights from customer research surveys can impact them:

To Know Your Target Market

Understanding your target audience is the fundamental aspect of market research, be it a new target market or existing customers. If you know what marketing research survey questions to ask your target market, you can identify different customer types’ unique traits and preferences.

The data can help you segment the users based on demographic, psychographic, geographic, and other attributes. These include their behavior, purchase preferences, age, location, habits, delights, frustrations, and more.

You can then create various customer personas and fuel your sales strategies to maximize ROI.

Case study – How Avis increased its revenue per customer

Avis, a leading car rental company, was looking to enhance customer experience by offering useful car add-ons like navigation systems, child seats, insurance, etc., to customers with their booking. So, it reached out to AWA Digital to find a way to promote these products and increase their sales.

AWA digital implemented customer research campaigns using targeted surveys to determine which add-ons were popular among the customers and why.

Using these insights, the team added an interstitial pop-up just before the booking page to show relevant add-ons to the customers.

This simple update dramatically increased the sales of add-on items and helped Avis generate more revenue per customer.

Read the entire case study here .

To Plan the Product Roadmap

A product roadmap is a visual representation of the current status of your product and planned updates over time. It shows a high-level summary of planned activities and priorities for different teams to take the product to the next level.

Steve Jobs famously said – “You’ve got to start with the customer experience and work backward to the technology. You can’t start with the technology then try to figure out where to sell it.”

And market research helps to align your product strategies with the customer demand. Using targeted marketing survey questions, you can gauge what new features or functionality customers want to see in your products.

It helps to plan product development strategies based on customers’ consensus to prioritize the ideas that can have the most impact on customers and replace intuition-based approaches with data-backed decisions.

Customers’ demands change with market trends and technological advancements. That’s why your product map also needs to evolve constantly with time to reflect these changes in your product development cycle.

By designing targeted market research questions to ask the customers, you can uncover their expectations to deliver optimal product solutions.

That’s what our next case study demonstrates.

Case study – How customer research drives Twilio’s operations

Twilio, a cloud communications platform places customer discovery and research at the core of their product development strategies. It helps its teams to anticipate customer needs in a constantly changing market.

Lack of time and budget are the two biggest challenges that the company faces in its product development cycle. So, the team uses targeted market research questionnaires for a product to understand the challenges the customers face today and the ones they will face tomorrow.

With an abundance of ideas and no time to test them all, the feedback data from surveys is used to prioritize the hypotheses to run the tests. It makes the process more efficient and effective in producing positive results.

This data-backed approach is used across 18 different teams at Twilio to release new functionality every week and deliver optimal solutions to the clients.

Read the complete case study here .

To Reduce Acquisition Costs

Your customer base consists of multiple customer segments with different preferences and purchase potential. That’s why you cannot sell to everyone and need to find the right audience for your products.

If an acquired customer doesn’t bring in more revenue than it costs to acquire them, it will increase your acquisition costs over time.

We don’t want that, do we?

For example, let’s say you are targeting the entire market population using the same campaign. If your acquisition cost per customer is $300 and you acquire 20 customers from one campaign, you need to make more than $6000 to register profits.

The difficulty is you don’t know about these customers’ purchase behavior and capacity, so you cannot be sure if you will reach your goals. It adds unnecessary risks to your marketing ventures.

But, if you were targeting a specific segment with high income, regular shopping habits, or proven history of brand loyalty, You can obtain better results.

Now, the question is –

How will you separate these potential long-term customers from one-time buyers and high-value targets from other segments?

One way to do this is by building customer personas using the data from the market research survey questions. A buyer persona defines different attributes of a particular customer segment so you can hone in on the right audience to funnel your marketing efforts.

Here’s what a typical persona includes:

- Target regions

- Target demographic (age, marital status, gender)

- Ideal psychographics (hobbies, social channels, activities they indulge in, goals)

- Preferred interaction channels

- Favorite brands and products

- Total revenue till date

- Estimated lifetime value

Once you have a clearer picture of different customers, you can find high-value prospects with the potential to be long-term customers looking for product solutions that your business offers.

You can then design the correct pitch using the market research data to bring in these customers and control the overall acquisition costs.

For example:

- Plugin the demographic and psychographic data into CRM software like BIGContacts or Salesforce to convert high-value targets.

- Use your CRM to create segmented lists of prospects based on estimated value, location, current status, and more. Then target these groups individually with personalized value propositions to increase conversion rates.

- Identify their preferred mode of communication and technographic inclinations to find the right opportunities to pitch your product offering at the precise moment.

Even if acquiring and retaining such customers costs more, their overall revenue can balance the acquisition costs to deliver higher profits.

To Design Targeted Marketing Campaigns

By knowing how your target audience behaves and interacts with your business, you can find the exact opportunities to target them with personalized campaigns.

- You can use mail campaigns to target website users with app-exclusive offers to encourage them to download your app and improve app adoption.

- Add in-app broadcast messages about upcoming offers, exclusive membership benefits, and other incentives for new users to push them towards the end of the funnel.

- Create multiple landing pages to target different customer types.

- Design location-based ad campaigns with personalized value propositions based on audience preferences and problems at each location.

Case Study – How Canon’s campaigns generated 700% ROI

AWA digital was tasked by Canon, one of the biggest electronics companies worldwide, to assess and increase the demand for their products in different geographies. So, the AWA team conducted customer research using target market survey questions and discovered the following attributes about customers’ purchase behavior and reservations:

- In some regions, people were reluctant to spend money on a Canon camera as they weren’t sure if Canon was an authoritative brand.

- In other regions, authority was not as important to the users.

Using these insights, AWA optimized the ads campaigns’ messaging for different locations to include what consumers deemed important purchase factors.

The results?

With in-depth customer feedback, Canon generated an overall ROI of 700% in all regions using personalized campaigns to target the audience.

To Improve Brand Awareness

Whether you are into soft drinks or not, You probably would have heard of Coca-Cola’s 2011 Share-A-Coke ad. This single campaign put the Coke brand back on the map and reversed the 10-year steady decline in sales in the US.

Coke understood what motivates their customers and delivered a product offering that appealed to the masses to increase its brand equity- the excitement to get a Coca-Cola bottle with their name on it.

How did they do it?

In 2011, Coca-Cola rolled out its share-a-coke campaign in Australia. The company debranded the traditional Coke logo from the bottle and replaced it with the phrase “Share a Coke with” followed by a name.

The campaign used the list of the country’s most popular names (nicknames). The purpose was to make people go out and find the Coke bottle with their name on it and share it with their friends. The campaign was subsequently rolled out in 80 countries.

How did it impact Coca-Cola as a brand:

- In Australia, it’s estimated that the campaign increased Coke’s share by 4% and increased consumption among young adults by 7%.

- #ShareACoke became the top trending hashtag on Twitter globally and received over 1 billion impressions.

- In the USA, the campaign increased Coke’s market share by over 2% and brought 11% more sales compared to the previous year.

It’s not limited to big brands only.

Understanding the customers and placing your product’s value offering along with their habits, lifestyle, and behavior can help you extend your brand’s reach.

Today, there are multiple touchpoints to connect with your customers and map their journey to uncover their issues, motivations, and fears to address in your campaigns.

- Monitor brand mentions on social media and engage with the users to cultivate an online community and promote your brand.

- Reach out to satisfied customers and turn them into your brand ambassadors.

- Use targeted ad campaigns that connect people’s emotions and general behavior to imprint your brand’s image in their minds.

Quick Tips for Writing Awesome Market Research Survey Questions

With the inter-team research complete, you are ready to write your own market research questions to ask your target audience. Keep these general dos and don’ts in mind to ensure that the market survey fulfills the purpose without affecting the data quality or response rate.

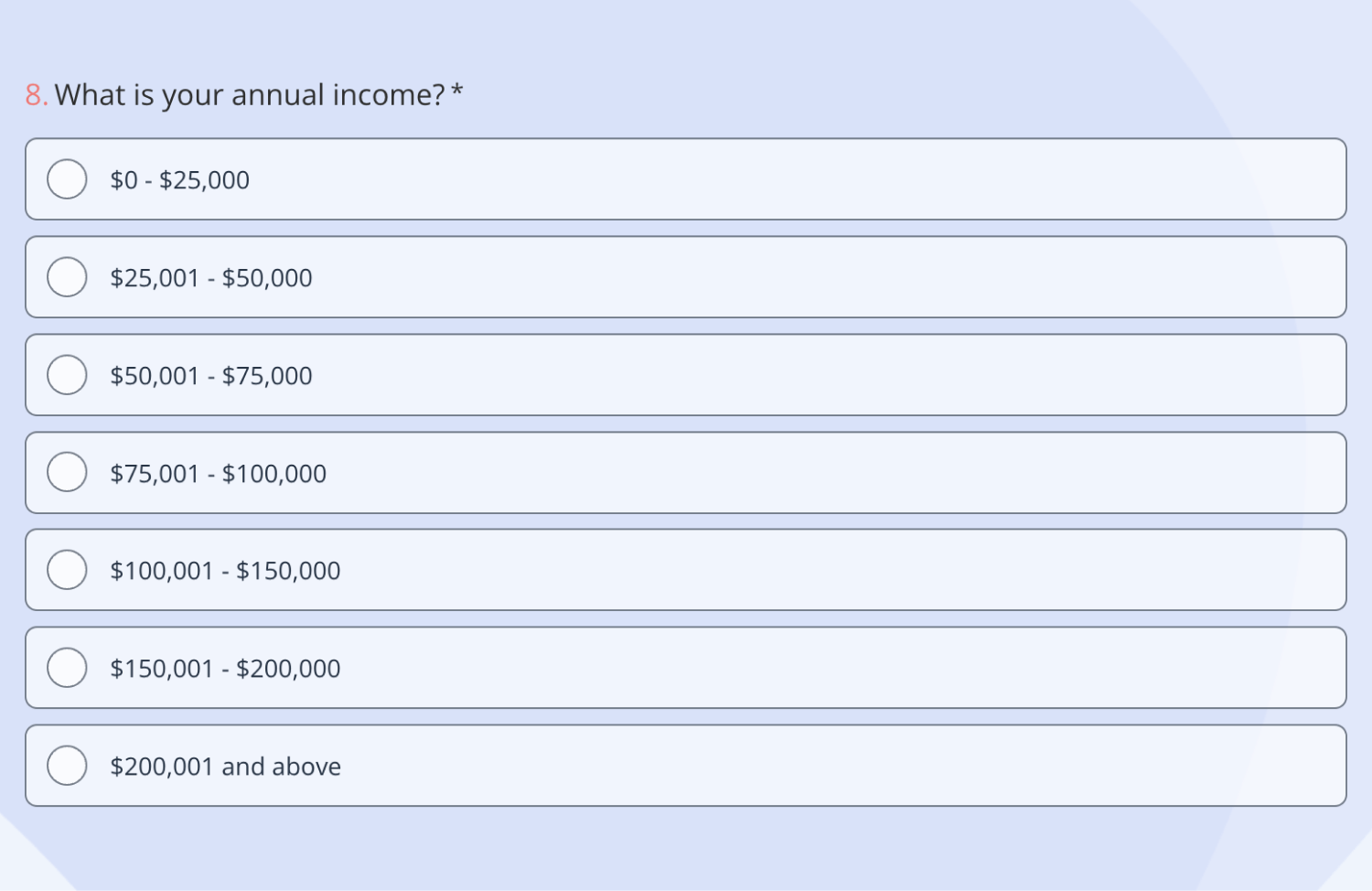

Use Mutually Exclusive Response Options

If you are using response anchors with specific ranges like age group or income, check that the options do not overlap . Otherwise, it will produce an irregular data set.

Please specify your age:

In the above example, the respondent lying on either extremity of the given age ranges may get confused on which option to choose. For example, a 28-year-old respondent can choose from both second or third options.

Plus, two different respondents of the same age may select different options, which will skew your demographic data.

You can avoid this confusion by creating mutually exclusive groups as shown below:

Always Add A “Not Applicable” Or “Rather Not Say” Option

Since market research questions extract personal information, some respondents may not want to share such details with you. These include questions about age, income, gender, hobbies, social activities, and more.

Forcing such questions on the customers without allowing them to skip can irate them and lead to survey abandonment .

That’s why you can also use Qualaroo’s skip and branching logic to create smart surveys that only ask relevant questions to your respondents based on their previous answers.

Calculate the Required Sample Size

Sample size plays a vital role in your market research questions to determine the reliability of your response data.

If the response volume is low, the results may not be conclusive to point towards customers’ consensus. On the other hand, a larger sample size than required means a waste of the company’s valuable resources and time.

That’s why it’s important to calculate the required sample size to estimate the number of responses you need for your market research survey questions.

You can use any survey sample size calculator available online to get started. Just fill in the required details to get the required sample size.

For example, to reach a statistical significance of 99%, you need at least 3145 responses to your market research questionnaire.

Consider Adding Incentives

Studies show that incentivized customer research surveys or questionnaires fetch higher response rates than general surveys.

The incentives encourage customers to invest their time in a survey and get something in return.

It means creating a gated questionnaire for market research can help you reach the required sample size quickly . The incentive can be a simple discount code, free shipping coupon, free ebook, or other freebies.

However, there is a possibility that irrelevant respondents may fill out the survey randomly just to get to the offer, which may skew the results. You can use screening questions to filter out unsuitable respondents.

Avoid Double-Barreled Market Research Questions

A double-barreled question poses two questions into one. The problem with such questions is that the respondent may have opposing views about the two statements in the questions. It makes it harder for them to choose one answer from the options .

“Please rate the [product name] on a scale of 1-10 based on overall quality and price?”

Here, the respondent may find the product quality appreciable while thinking it to be overpriced at the same time. In such a case, they may skip the question or select any option randomly.

You can easily sidestep this hurdle by breaking your double-barreled market research question into two to make it less confusing for the respondents.

Importance of Market Research

We mentioned earlier that market research questions provide important data for different operations like product development, marketing campaigns, sales pipeline, and more.

Understanding your target audience is the fundamental aspect of market research, be it a new target market or existing customers. If you know what customer research survey questions to ask your target market, you can identify different customer types’ unique traits and preferences.

AWA Digital implemented research campaigns using targeted customer research surveys to determine which add-ons were popular among the customers and why.

Steve Jobs famously said – “You’ve got to start with the customer experience and work backward to the technology. You can’t start with the technology and then try to figure out where to sell it.”

And market research helps to align your product strategies with the customer demand. Using targeted customer research survey questions, you can gauge what new features or functionality customers want to see in your products.

Image Source: Slide Team

By designing targeted market research questions to ask the customers, you can uncover their expectations to deliver optimal product solutions.

Case study – How customer research drives Twilio’s operations

Twilio, a cloud communications platform, places customer discovery and research at the core of its product development strategies. It helps its teams to anticipate customer needs in a constantly changing market.

Lack of time and budget are the two biggest challenges that the company faces in its product development cycle. So, the team uses targeted market research questionnaires for a product to understand the challenges the customers face today and the ones they will face tomorrow.

With an abundance of ideas and no time to test them all, the feedback data from customer research surveys is used to prioritize the hypotheses to run the tests. It makes the process more efficient and effective in producing positive results.

Your customer base comprises multiple customer segments with different preferences and purchase potential. That’s why you cannot sell to everyone and need to find the right audience for your products.

For example, let’s say you target the entire market using the same campaign. If your acquisition cost per customer is $300 and you acquire 20 customers from one campaign, you must make over $6000 to register profits.

But, if you were targeting a specific segment with high income, regular shopping habits, or a proven history of brand loyalty, you could obtain better results.

Now, the question is –

Image Source: brightspark

- Plug the demographic and psychographic data into CRM software like BIGContacts or Salesforce to convert high-value targets.

- Use your CRM to create segmented lists of prospects based on estimated value, location, current status, and more. Then, target these groups individually with personalized value propositions to increase conversion rates.

- Add in-app broadcast messages about upcoming offers, exclusive membership benefits, and other incentives for new users to push them toward the end of the funnel.

AWA Digital was tasked by Canon, one of the biggest electronics companies worldwide, to assess and increase the demand for their products in different geographies. So, the AWA team conducted a customer research survey using target market questions and discovered the following attributes about customers’ purchase behavior and reservations:

- In other regions, authority was not so important to the users.

Whether you are into soft drinks or not, you probably would have heard of Coca-Cola’s 2011 Share-A-Coke ad. This single campaign put the Coke brand back on the map and reversed the 10-year steady decline in sales in the US.

Coke understood what motivates its customers and delivered a product offering that appealed to the masses to increase its brand equity- the excitement to get a Coca-Cola bottle with its name on it.

- In Australia, it’s estimated that the campaign increased Coke’s share by 4% and consumption among young adults by 7%.

It’s not limited to big brands only.

Market Research: A Key to Your Business’ Success

Market research is a vital process for any business wanting to understand its customers and market better. By asking the right questions and using the right tools like Qualaroo, you can gain valuable insights that can help you improve your products or services, enhance your customer experiences, and grow your business.

In this blog, we have shared some of the best market research questions to ask your customers, as well as some of the best customer research survey templates to find market trends and industry insights. We hope that this blog has helped you learn more about market research and how to conduct it effectively.

About the author

Shivani dubey.

Shivani has more than 3 years of experience in the modern creative content paradigm and technical writing verticals. She has been published in The Boss Magazine, Reseller Club, and HR Technologist. She is passionate about Artificial Intelligence and has a deep understanding of how organizations can leverage customer support technologies for maximum success. In her free time, she enjoys Nail art, playing with her guinea pigs, and chilling with a bowl of cheese fries.

- 33 Best Market Research Question Examples

To build a successful business, it is important to gather useful insights through market research. More than anything else, carrying out market research helps you to collect necessary information and make the right business decisions with regard to market segmentation and product differentiation.

In this article, we will share sample questionnaires for different types of market research; specifically product, client, and customer market research. We will also show you how to use Formplus to create a simple online research questionnaire in no time.

What is Market Research?

Market research is the process of gathering valuable information about the needs of your target market, consumer behaviors, and market challenges. Conducting market research helps you to determine the feasibility of a product or service before its introduction to the market.

During market research , an organization can collect primary and/or secondary data. Primary data refers to information that is collected directly from the research participants and target markets while secondary data refers to already-processed information about the research context and subject(s).

Importance of Market Research

- Improves Sales

Market research provides unique insights into the expectations of your customers and clients, which helps you tailor your product to meet their specific needs. This would ultimately help to increase your sales.

- Identifying New Business Opportunities

With market research, you’d be able to spot untapped business opportunities in your industry and work on building a product in line with this. You can discover new geographical concentrations for your target market, for instance.

- Reduces Business Risks

As a business owner, your priority should be taking calculated risks and this can be achieved when you have forehand knowledge of the dynamics of your industry. Conducting market research arms you with useful insights that will help you make the right business decisions.

- Advertising

Market research also improves your advertising by helping you to identify the best channels to reach your customers. You’d better understand market demographics and also know the channels that can yield the best returns in terms of lead generation and sales.

- Competitive Advantage

With better knowledge of market needs and consumers’ preferences, you’d stay ahead of your competition. For instance, you can identify neglected market segments and focus on penetrating them.

Market Research Questionnaire Examples for Product

Product market research questions trigger responses that reveal how well-suited your product is for the target market. The right product-market research questions provide useful insight into the feasibility of the product before it is launched. Here are 11 question samples for your product market research questionnaire.

- What is your deciding factor for product patronage?

This question would help you focus your product’s unique selling point on what the target market considers valuable. For instance, if the deciding factor for your target market is affordability, you would want to work on a fair pricing rate for your product.

- How likely are you to purchase groceries online?

Since you want to create a product that satisfies a specific need, you need to be sure your target market would be willing to buy into your idea. If the market has no need for an online grocery store, there’s little or no reason for you to launch one.

- Which product features are most valuable to you?

You can tweak this question in line with your specific product. Data gathered via responses would help you identify the product features you need to invest in.

- Would you be willing to subscribe to a weekly business newsletter?

Questions like this would help you decide whether you need to go ahead with a specific development plan for your business. If you want to launch a newsletter, it helps to know if you have a willing audience for it.

- Would you like to process orders and payments in a single form?

This type of question would help you identify the need(s) of the market and you can work on creating a product or developing a feature to meet this need.

- Who is your trusted internet service provider?

If you’re looking to penetrate a new market, it is important for you to identify the existing competition; that is, organizations that provide similar services in your industry. Asking prospective customers to identify the brands they trust is an essential part of your competitive analysis.

- What challenges do you face with 3rd party logistics companies?

This question would help you to identify the specific needs of your target market. You can focus your product on providing solutions to the challenges highlighted.

- Would you find this product useful?

This is a straightforward question to determine whether your product fills a specific need in the market.

- Would you be willing to pay in installments for this service?

Questions like this would help you identify product features that your target market considers to be valuable.

- How much are you willing to pay for this product?

This question would help you fix a reasonable price for your product. While your product may be excellent, ensuring its affordability is key to penetrating the market effectively.

- How much do you spend on groceries every month?

This question would provide insights into the purchasing power of your target market.

Read: Research Questions: Definition, Types, +[Examples]

Market Research Questionnaire Examples for Customer

To better under your customers’ perceptions of your product, you can create and administer a market research questionnaire. A market research questionnaire for your customers should include questions that focus on the usefulness of different aspects of your product delivered to your customers.

You’d also want to centralize questions that bother on customer demographics, challenges, specific needs of your customers, and how your product meets these needs. Here are 11 specific questions you can include in your market research questionnaire for customers:

Demographic Questions

These questions will help you better understand who your customers are and also help you create an accurate buyer persona. Knowing who your customers are and what appeals to them means that you would be able to focus your product on what appeals to them.

- What is your monthly income range?

Knowing how much your customers earn gives you a hint of their purchasing power and how much they can typically spend on your product. This will inform the pricing of your product so that you do not price yourself out of business.

- How much do you spend on shopping every month?

Just like you, customers work with a budget and are more likely to purchase products whose costs fit into this. Responses to this question will help you fix an appropriate fee on your product.

- Where do you prefer to shop?

Catering to customer preferences is one way of securing repeated patronage. Responses to this question will inform your business expansion plan. For example, if your customers prefer shopping online, you can set up a Formplus online order form to allow them to place orders for items and make payments conveniently.

- How old are you?

This question will help you identify the age group that your product appeals to the most. Knowing this would help you craft marketing and advertising campaigns that appeal to the members of this group.

Feedback Questions

These questions help you to collect insightful information about customer experience; that is, how customers perceive your product and overall delivery. Responses to these questions would let you know why your customers buy from you and how well your product meets their needs.

- What specific needs does our product meet for you?

This question helps you to identify the unique selling point of your product. You would know why customers patronize your brand and you can leverage this information for better marketing and advertising.

- How would you rate our product delivery?

Responses to this question are a direct reflection of your customer’s perceptions of your product delivery. For better insight, you can ask them to provide reasons for their ratings.

- What challenges did you encounter while using our product?

These questions help you to identify business weaknesses from the point of view of the end user. If left unattended to, competitors can capitalize on these weaknesses to increase their customer base.

- How likely are you to recommend our product?

Happy customers are one of the most effective marketing tools as customers will only recommend a product they are satisfied with. If more people are eager to recommend your product, it means that your business and brand is on the right track.

Other market research question samples are:

- How would you rate our customer experience?

Feedback on customer experience is important because it helps you improve your brand’s relations with its customers across different business touchpoints.

- What do you think about product pricing?

This question would help you adjust your product pricing appropriately. If customers think your product is too expensive, they may stop buying from you.

- How often do you use our product?

This question would help you track repeated patronage and to know how your product fits into your customers’ everyday lives.

Market Research Questionnaire Examples for Client

Clients are individuals and organizations that you provide specific services for. Just like with customer market research questions, market research questions for clients help you assess your service delivery, identify clients’ unique needs, and gather useful insights via feedback. Here are 11 sample questions for you:

- How would you rate our service delivery?

This is a feedback question that will help you understand how well your service meets your client’s needs.

- What challenges are you experiencing with our services?

Responses to this question would highlight areas needing improvement in your overall service delivery.

- Would you be willing to recommend us to your network?

If the answers to this question are in the affirmative, then you can be sure that your clients are quite impressed with the service you provide.

- What specific needs do our services meet for you?

To clearly map out the value of your product from the clients’ perspectives, ask them to identify the specific needs your services meet for them.

- How can our service delivery be better?

This is another feedback question that would help you improve your services to better cater to the needs of your clients.

- For how long have you been a client?

This question helps you to gather meaningful data to improve your client retention strategies.

- What do you like the most about our services?

This question would help you identify the unique selling point of your services.

- How would you rate your last experience with us?

With this question, you’d be able to gather valuable information about a client’s experience with your services.

- What do you dislike about our service delivery?

This question allows clients to highlight areas needing improvement in your service delivery. The data gathered would help you improve your services for the benefit of your clients.

- Are our services helpful?

This is a simple question that requires clients to highlight the value of your services.

- Why did you choose us?

How to Create an Online Research Questionnaire

With Formplus, it is easier for you to create and administer an online questionnaire for market research. In the drag-and-drop form builder, you can add preferred form fields and edit them to suit specific research needs. Here’s a step-by-step guide on how to go about it:

- Sign in to your Formplus account. In your dashboard, click on “create new form” to get started on your online research questionnaire.

- Drag and drop preferred fields into your online questionnaire. You can edit form fields to include market research questions. You can also make some fields hidden or read-only depending on your research needs.

- Use the form customization options to tweak the appearance of the online research questionnaire. You can add preferred background images, add your organization’s logo or tweak the form font.

- Finally, copy the form link and share it with form respondents. You can use one or more of the multiple sharing options including the social media direct sharing buttons and the email invitation option.

Conclusion

While creating your market research questionnaire, it is important for you to tailor its questions to specific contexts. For instance, if you are conducting product market research, you should ask questions that would provide useful information on product feasibility among other things.

Conducting market research yields multiple benefits for your business. To make the process seamless and easy to coordinate, you can set up an online research questionnaire with Formplus and share this with your customers, clients, and target market(s).

Connect to Formplus, Get Started Now - It's Free!

- market research

- market research questionnaire

- busayo.longe

You may also like:

Target Market: Definitions, Examples + [Audience Identification]

Without knowledge of your target market, your entire product conception and marketing process is flawed. This article covers practical...

Projective Techniques In Surveys: Definition, Types & Pros & Cons

Introduction When you’re conducting a survey, you need to find out what people think about things. But how do you get an accurate and...

Margin of error – Definition, Formula + Application

In this article, we’ll discuss what a margin of error means, its related concepts, the formula for calculating it and some real-life applications

Taste Testing Market Research & How it Works

Introduction The purpose of taste testing is to determine the preferences of consumers. It is an important part of marketing research...

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

Business growth

Marketing tips

How to conduct your own market research survey (with example)

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Experiences

Preferences, desires, and needs

Values and motivations