- Economy & Politics ›

Impact of the coronavirus pandemic on the global economy - Statistics & Facts

Affected industries, country and regional comparison: uk economy hit hard, china less affected, key insights.

Detailed statistics

Forecasted global real GDP growth 2019-2024

Global unemployment rate 2004-2023

Monthly change in goods trade globally 2018-2024

Editor’s Picks Editor’s Picks Current statistics on this topic

Key Economic Indicators

GDP growth rate of the world's seven largest economies 2021, by country

Projected GDP growth in China 2024

Recommended statistics

Global economic impact.

- Basic Statistic Cumulative cases of COVID-19 worldwide from Jan. 22, 2020 to Jun. 13, 2023, by day

- Basic Statistic COVID-19 cases worldwide as of May 2, 2023, by country or territory

- Premium Statistic GDP loss due to COVID-19, by economy 2020

- Premium Statistic Forecasted global real GDP growth 2019-2024

- Premium Statistic Value of COVID-19 stimulus packages in the G20 as share of GDP 2021

- Basic Statistic Number of unemployed persons worldwide 1991-2024

- Premium Statistic COVID-19: effect on income groups globally 2020

- Premium Statistic Central bank policy rates in advanced and emerging economies 2019-2024

Cumulative cases of COVID-19 worldwide from Jan. 22, 2020 to Jun. 13, 2023, by day

Number of cumulative cases of coronavirus (COVID-19) worldwide from January 22, 2020 to June 13, 2023, by day

COVID-19 cases worldwide as of May 2, 2023, by country or territory

Number of coronavirus (COVID-19) cases worldwide as of May 2, 2023, by country or territory

GDP loss due to COVID-19, by economy 2020

Share of Gross Domestic Product (GDP) lost as a result of the coronavirus pandemic (COVID-19) in 2020, by economy

Global real Gross Domestic Product (GDP) growth after the coronavirus (COVID-19) from 2019 with a forecast until 2024

Value of COVID-19 stimulus packages in the G20 as share of GDP 2021

Value of COVID-19 fiscal stimulus packages in G20 countries as of May 2021, as a share of GDP

Number of unemployed persons worldwide 1991-2024

Number of unemployed persons worldwide from 1991 to 2024 (in millions)

COVID-19: effect on income groups globally 2020

Change in number of people in selected income tiers due to the coronavirus (COVID-19) pandemic worldwide in 2020 (in millions)

Central bank policy rates in advanced and emerging economies 2019-2024

Central bank policy rates in major advanced and emerging economies from September 2019 to July 2024

Stock markets and COVID-19

- Premium Statistic Change in global stock index values during coronavirus outbreak 2020

- Basic Statistic Share price index in major developed and emerging economies 2019-2023

- Basic Statistic Monthly Shanghai Stock Exchange Composite Index performance 2018-2024

- Premium Statistic Coronavirus impact on the CAC 40 index in France 2020-2024

- Basic Statistic Weekly development DAX Index 2024

- Premium Statistic Weekly development Dow Jones Industrial Average Index 2020-2024

Change in global stock index values during coronavirus outbreak 2020

Change in value during coronavirus outbreak of selected stock market indices worldwide from January 1 to March 18, 2020

Share price index in major developed and emerging economies 2019-2023

Share price index in major developed and emerging economies from January 2019 to June 2023

Monthly Shanghai Stock Exchange Composite Index performance 2018-2024

Monthly development of the Shanghai Stock Exchange Composite Index from July 2018 to July 2024

Coronavirus impact on the CAC 40 index in France 2020-2024

Impact of the coronavirus (COVID-19) outbreak on the CAC 40 index in France from January 24, 2020 to October 10, 2024

Weekly development DAX Index 2024

Weekly development of the DAX Index from January 2020 to October 2024

Weekly development Dow Jones Industrial Average Index 2020-2024

Weekly development of the Dow Jones Industrial Average Index from January 2020 to October 2024

Impact on major industries

- Basic Statistic Weekly flights change of global airlines due to COVID-19 as of January 2021

- Basic Statistic Weekly oil prices in Brent, OPEC basket, and WTI futures 2022-2024

- Premium Statistic Global PMI for manufacturing and new export orders 2018-2024

- Premium Statistic Global merchandise imports index 2019-2024, by region

- Premium Statistic Global merchandise exports index 2019-2024, by region

- Premium Statistic Industrial production growth worldwide 2019-2024, by region

Weekly flights change of global airlines due to COVID-19 as of January 2021

Year-on-year change of weekly flight frequency of global airlines from January 6, 2020 to January 4, 2021, by country

Weekly oil prices in Brent, OPEC basket, and WTI futures 2022-2024

Closing price of Brent, OPEC basket, and WTI crude oil at the beginning of each week from October 31, 2022 to October 28, 2024 (in U.S. dollars per barrel)

Global PMI for manufacturing and new export orders 2018-2024

Global Purchasing Manager Index (PMI) for manufacturing and new export orders from January 2018 to September 2024

Global merchandise imports index 2019-2024, by region

Global merchandise imports index between January 2019 to August 2024, by region

Global merchandise exports index 2019-2024, by region

Global merchandise exports index from January 2019 to August 2024, by region

Industrial production growth worldwide 2019-2024, by region

Global industrial production growth from January 2019 to July 2024, by region

Impact on trade and world's largest economies

- Premium Statistic GDP growth rate of the world's seven largest economies 2021, by country

- Premium Statistic Business confidence index among the world's seven largest economies 2020-2024

- Premium Statistic Change in GDP and trade volume globally 2007-2026

- Premium Statistic Monthly change in goods trade globally 2018-2024

GDP growth rate of the world's seven largest economies 2021, by country

GDP growth rate of the world's seven largest economies as of 3rd quarter of 2021, by country (compared to growth rate in 2020)

Business confidence index among the world's seven largest economies 2020-2024

Business confidence index (BCI) among the world's seven largest economies from January 2020 to September 2024*

Change in GDP and trade volume globally 2007-2026

Growth in GDP and trade volume worldwide from 2007 to 2023, with a forecast until 2026

Change in global goods trade volume from January 2018 to July 2024

Impact on Asia

- Basic Statistic GDP growth rate APAC 2017-2025, by sub-region

- Premium Statistic Projected GDP growth in China 2024

- Premium Statistic Cumulative number of workers to be fired due to COVID-19 Japan 2023, by industry

- Basic Statistic Estimated quarterly impact from COVID-19 on India's GDP FY 2020-2022

- Premium Statistic COVID-19 impact on unemployment rate in India 2020-2022

- Basic Statistic Estimated economic impact from COVID-19 in India 2020-21, by sector

GDP growth rate APAC 2017-2025, by sub-region

Growth rate of real gross domestic product (GDP) in the Asia-Pacific region from 2017 to 2023, with a forecast until 2025, by sub-region

Median forecast for China's GDP growth rates in 2024 and 2025 as of October 2024

Cumulative number of workers to be fired due to COVID-19 Japan 2023, by industry

Cumulative number of employees who are planned to be dismissed due to the coronavirus disease (COVID-19) impact in Japan as of March 2023

Estimated quarterly impact from COVID-19 on India's GDP FY 2020-2022

Estimated quarterly impact from the coronavirus (COVID-19) on India's GDP growth in financial year 2020 to 2022

COVID-19 impact on unemployment rate in India 2020-2022

Impact on unemployment rate due to the coronavirus (COVID-19) lockdown in India from January 2020 to May 2022

Estimated economic impact from COVID-19 in India 2020-21, by sector

Estimated impact from the coronavirus (COVID-19) on India from April 2020 to September 2021, by sector

Impact on Europe

- Premium Statistic GDP growth rate forecasts in European Union 2025

- Basic Statistic Market capital value of Europe's largest banks since the coronavirus 2019-2024

- Basic Statistic Market capitalizatio of European stock exchanges since Coronavirus outbreak 2019-2024

- Premium Statistic Impact of coronavirus (COVID-19) on real GDP in Italy 2021-2022

- Basic Statistic German export expectations for manufacturing 1991-2024

- Premium Statistic Coronavirus (COVID-19) impact on GDP growth in France 2020, by scenario

- Basic Statistic Impact of COVID-19 on GDP dynamics in CEE region 2020

GDP growth rate forecasts in European Union 2025

Gross domestic product growth rate forecasts in the European Union in 2025, by member state (percentage increase on previous period)

Market capital value of Europe's largest banks since the coronavirus 2019-2024

Monthly market capitalization of Europe's largest banks since the coronavirus from December 2019 to March 2024 (in billion U.S. dollars)

Market capitalizatio of European stock exchanges since Coronavirus outbreak 2019-2024

Monthly market capitalization of European stock exchanges since the Coronavirus outbreak between December 2019 and March 2024 (in billion U.S. dollars)

Impact of coronavirus (COVID-19) on real GDP in Italy 2021-2022

Impact of coronavirus (COVID-19) on real gross domestic product (GDP) growth in Italy in 2021 and 2022

German export expectations for manufacturing 1991-2024

Monthly balance values of the ifo export expectations for the German manufacturing sector from January 1991 to September 2024 (seasonally adjusted)

Coronavirus (COVID-19) impact on GDP growth in France 2020, by scenario

Forecasted impact of the novel coronavirus COVID-19 on real gross domestic product (GDP) growth in France from 2020, by scenario

Impact of COVID-19 on GDP dynamics in CEE region 2020

Negative impact of the coronavirus (COVID-19) epidemic on GDP dynamics in Central and Eastern European countries in 2020

Impact on the United States

- Basic Statistic U.S. real GDP growth by quarter Q2 2013- Q2 2024

- Basic Statistic U.S. unemployment insurance claims per week December 2022

- Basic Statistic U.S. seasonally adjusted unemployment rate 2022-2024

- Basic Statistic U.S. unemployment rate 2024, by industry and class of worker

- Basic Statistic U.S. monthly change in nonfarm payroll employment 2024, by industry

- Basic Statistic U.S. monthly change in chained inflation 2024-2024

- Premium Statistic Share of workers and businesses impacted by COVID-19 2020

U.S. real GDP growth by quarter Q2 2013- Q2 2024

Annualized growth of real GDP in the United States from the second quarter of 2013 to the second quarter of 2024

U.S. unemployment insurance claims per week December 2022

Number of initial unemployment insurance claims made per week in the United States from the beginning of the pandemic to December 2022 (in 1,000s)

U.S. seasonally adjusted unemployment rate 2022-2024

Monthly unemployment rate in the United States from September 2022 to September 2024 (seasonally-adjusted)

U.S. unemployment rate 2024, by industry and class of worker

Unemployment rate in the United States in September 2024, by industry and class of worker

U.S. monthly change in nonfarm payroll employment 2024, by industry

Monthly change in nonfarm payroll employment in the United States in September 2024, by industry sector (in 1,000s)

U.S. monthly change in chained inflation 2024-2024

Monthly change in the chained inflation rate in the United States from August 2024 to August 2024

Share of workers and businesses impacted by COVID-19 2020

Share of workers and businesses impacted by the COVID-19 outbreak on in the United States as of March 24, 2020, by effect

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

The Economic Impact of COVID-19 around the World

This article provides an account of the worldwide economic impact of the COVID-19 shock. In 2020, it severely impacted output growth and employment, particularly in middle-income countries. Governments responded primarily by increasing expenditure, supported by an expansion of the supply of money and debt. These policies did not put upward pressure on prices until 2021. International trade was severely disrupted across all regions in 2020 but subsequently recovered. For 2021, we find that the adverse effects of the COVID-19 shock on output and prices were significant and persistent, especially in emerging and developing countries.

Introduction

For over two years, the world has been battling the health and economic consequences of the COVID-19 pandemic. As of the writing of this article, deaths attributed to COVID-19 have surpassed six-and-a-half million people. Global economic growth was severely impacted: World output by the end of 2021 was more than 4 percentage points below its pre-pandemic trend. International trade was also significantly disrupted at the onset of the pandemic. The pandemic also prompted a strong policy response, resulting in a rise of government deficits and debt as well as widespread increases in the money supply. Finally, after an initial decline, prices have soared, resulting in elevated inflation rates.

This article provides an account of the worldwide economic impact of the COVID-19 shock. This shock was not felt simultaneously around the world, and mitigation policies, both health related and economic, varied substantially across countries. Yet there are some significant similarities in outcomes, especially when considering the pandemic period as a whole. Our analysis focuses on the shock's effects on specific groups of countries, related by their level of development and geographical location.

We find that the COVID-19 shock severely impacted output growth and employment in 2020, particularly in middle-income countries. The government response, mainly consisting of increased expenditure, implied a rise in debt levels. Advanced countries, having easier access to credit markets, experienced the highest increase in indebtedness. All regions also relied on monetary policy to support the fiscal expansion, and hence the money supply increased everywhere. The specific circumstances surrounding the shock implied that the expansionary fiscal and monetary policies did not put upward pressure on prices until 2021. International trade was severely disrupted across all regions in 2020 but subsequently recovered. When extending the analysis to 2021, we find that the adverse effects of the shock on output and prices have been significant and persistent, especially in emerging and developing countries.

Fernando M. Martin is an economist and senior economic policy advisor at the Federal Reserve Bank of St. Louis. His research interests include macroeconomics, monetary economics, banking and public finance. He joined the St. Louis Fed in 2011. Read more about his work .

Juan M. Sánchez is an economist and senior economic policy advisor at the Federal Reserve Bank of St. Louis. He has conducted research on several topics in macroeconomics involving financial decisions by firms, households and countries. He has been at the St. Louis Fed since 2010. View more about the author and his research.

Olivia Wilkinson is a research associate at the Federal Reserve Bank of St. Louis.

Related Topics

Fernando M. Martin, Juan M. Sánchez and Olivia Wilkinson, "The Economic Impact of COVID-19 around the World," Federal Reserve Bank of St. Louis Review , Second Quarter 2023, pp. 74-88. https://doi.org/10.20955/r.105.74-88

Editors in Chief Michael Owyang and Juan Sanchez

This journal of scholarly research delves into monetary policy, macroeconomics, and more. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System. View the full archive (pre-2018) .

Media questions

Chapter 1. The economic impacts of the COVID-19 crisis

The COVID-19 pandemic sent shock waves through the world economy and triggered the largest global economic crisis in more than a century. The crisis led to a dramatic increase in inequality within and across countries. Preliminary evidence suggests that the recovery from the crisis will be as uneven as its initial economic impacts, with emerging economies and economically disadvantaged groups needing much more time to recover pandemic-induced losses of income and livelihoods . 1

In contrast to many earlier crises, the onset of the pandemic was met with a large, decisive economic policy response that was generally successful in mitigating its worst human costs in the short run. However, the emergency response also created new risks—such as dramatically increased levels of private and public debt in the world economy—that may threaten an equitable recovery from the crisis if they are not addressed decisively.

Worsening inequality within and across countries

The economic impacts of the pandemic were especially severe in emerging economies where income losses caused by the pandemic revealed and worsened some preexisting economic fragilities. As the pandemic unfolded in 2020, it became clear that many households and firms were ill-prepared to withstand an income shock of that scale and duration. Studies based on precrisis data suggest, for example, that more than 50 percent of households in emerging and advanced economies were not able to sustain basic consumption for more than three months in the event of income losses . 2 Similarly, the average business could cover fewer than 55 days of expenses with cash reserves . 3 Many households and firms in emerging economies were already burdened with unsustainable debt levels prior to the crisis and struggled to service this debt once the pandemic and associated public health measures led to a sharp decline in income and business revenue.

The crisis had a dramatic impact on global poverty and inequality. Global poverty increased for the first time in a generation, and disproportionate income losses among disadvantaged populations led to a dramatic rise in inequality within and across countries. According to survey data, in 2020 temporary unemployment was higher in 70 percent of all countries for workers who had completed only a primary education. 4 Income losses were also larger among youth, women, the self-employed, and casual workers with lower levels of formal education . 5 Women, in particular, were affected by income and employment losses because they were likelier to be employed in sectors more affected by lockdown and social distancing measures . 6

Similar patterns emerge among businesses. Smaller firms, informal businesses, and enterprises with limited access to formal credit were hit more severely by income losses stemming from the pandemic. Larger firms entered the crisis with the ability to cover expenses for up to 65 days, compared with 59 days for medium-size firms and 53 and 50 days for small and microenterprises, respectively. Moreover, micro-, small, and medium enterprises are overrepresented in the sectors most severely affected by the crisis, such as accommodation and food services, retail, and personal services.

The short-term government responses to the crisis

The short-term government responses to the pandemic were extraordinarily swift and encompassing. Governments embraced many policy tools that were either entirely unprecedented or had never been used on this scale in emerging economies. Examples are large direct income support measures, debt moratoria, and asset purchase programs by central banks. These programs varied widely in size and scope (figure 1.1), in part because many low-income countries were struggling to mobilize resources given limited access to credit markets and high precrisis levels of government debt. As a result, the size of the fiscal response to the crisis as a share of the gross domestic product (GDP) was almost uniformly large in high-income countries and uniformly small or nonexistent in low-income countries. In middle-income countries, the fiscal response varied substantially, reflecting marked differences in the ability and willingness of governments to spend on support programs.

Figure 1.1 Fiscal response to the COVID-19 crisis, selected countries, by income group

Similarly, the combination of policies chosen to confront the short-term impacts differed significantly across countries, depending on the availability of resources and the specific nature of risks the countries faced (figure 1.2). In addition to direct income support programs, governments and central banks made unprecedented use of policies intended to provide temporary debt relief, including debt moratoria for households and businesses. Although these programs mitigated the short-term liquidity problems faced by households and businesses, they also had the unintended consequence of obscuring the true financial condition of borrowers, thereby creating a new problem: lack of transparency about the true extent of credit risk in the economy.

Figure 1.2 Fiscal, monetary, and financial sector policy responses to the COVID-19 crisis, by country income group

The large crisis response, while necessary and effective in mitigating the worst impacts of the crisis, led to a global increase in government debt that gave rise to renewed concerns about debt sustainability and added to the widening disparity between emerging and advanced economies. In 2020, 51 countries—including 44 emerging economies—experienced a downgrade in their government debt risk rating (that is, the assessment of a country’s creditworthiness) . 7

Emerging threats to an equitable recovery

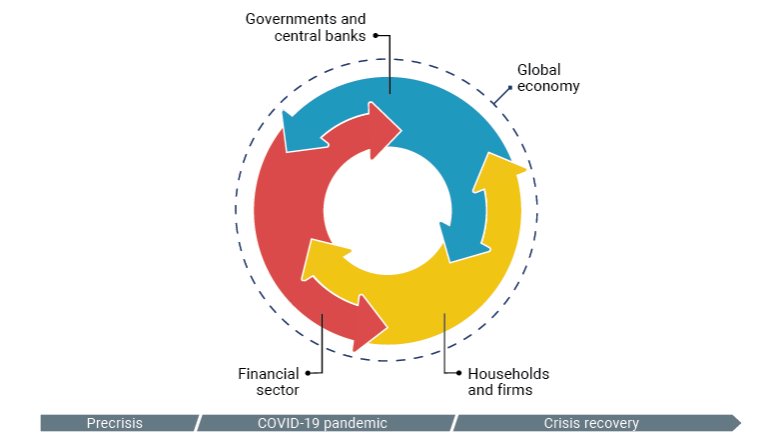

Although households and businesses have been most directly affected by income losses stemming from the pandemic, the resulting financial risks have repercussions for the wider economy through mutually reinforcing channels that connect the financial health of households, firms, financial institutions, and governments (figure 1.3). Because of this interconnection, elevated financial risk in one sector can spill over and destabilize the economy as a whole. For example, if households and firms are under financial stress, the financial sector faces a higher risk of loan defaults and is less able to provide credit. Similarly, if the financial position of the public sector deteriorates (for example, as a result of higher government debt and lower tax revenue), the ability of the public sector to support the rest of the economy is weakened.

Figure 1.3 Conceptual framework: Interconnected balance sheet risks

This relationship is, however, not predetermined. Well-designed fiscal, monetary, and financial sector policies can counteract and reduce these intertwined risks and can help transform the links between sectors of the economy from a vicious doom loop into a virtuous cycle.

One example of policies that can make a critical difference are those targeting the links between the financial health of households, businesses, and the financial sector. In response to the first lockdowns and mobility restrictions, for example, many governments supported households and businesses using cash transfers and financial policy tools such as debt moratoria. These programs provided much-needed support to households and small businesses and helped avert a wave of insolvencies that could have threatened the stability of the financial sector.

Similarly, governments, central banks, and regulators used various policy tools to assist financial institutions and prevent risks from spilling over from the financial sector to other parts of the economy. Central banks lowered interest rates and eased liquidity conditions, making it easier for commercial banks and nonbank financial institutions such as microfinance lenders to refinance themselves, thereby allowing them to continue to supply credit to households and businesses.

The crisis response will also need to include policies that address the risks arising from high levels of government debt to ensure that governments preserve their ability to effectively support the recovery. This is an important policy priority because high levels of government debt reduce the government’s ability to invest in social safety nets that can counteract the impact of the crisis on poverty and inequality and provide support to households and firms in the event of setbacks during the recovery.

➜ Read the Full Chapter (.pdf) : English ➜ Read the Full Report (.pdf) : English ➜ WDR 2022 Home

CHAPTER SUMMARIES

➜ Chapter 1 ➜ Chapter 2 ➜ Chapter 3 ➜ Chapter 4 ➜ Chapter 5 ➜ Chapter 6

RELATED LINKS

➜ Blog Posts ➜ Press and Media ➜ Consultations ➜ WDR 2022 Core Team

WDR 2022 Video | Michael Schlein: President & CEO of Accion

Wdr 2022 video | chatib basri: former minister of finance of indonesia.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

The economic impact of COVID-19

Share this:.

Direct costs

Indirect costs, supply shocks, manufacturing and production, supply chain disruption, other health considerations, demand shocks, capital flows and trade in goods and services, travel and tourism, personal consumption (retail sales, restaurants etc), financial market losses, please support now:.

Please make a gift today >

Related articles

Communications in the coronavirus crisis

A million reasons for talking to Professor Martin Landray

£50m funding for Poonawalla Vaccines Research Building at Oxford University

IMAGES

VIDEO

COMMENTS

Learn more about the impact of COVID-19 on the global economy, the shifts in stock markets, and the response of the major industries.

Key maps and charts explain how the virus has impacted markets and businesses around the world.

This article looks at the impact of COVID-19 in different areas of the world. First, I put 171 nations into three groups according to per capita income: low, middle and high income. Second, I examined health statistics to show how hard-hit by the virus these nations were.

This article provides an account of the worldwide economic impact of the COVID-19 shock. In 2020, it severely impacted output growth and employment, particularly in middle-income countries.

The COVID-19 global pandemic has caused significant global economic and social disruption. We use global data on cases and deaths, and public health and economic policy responses to the pandemic, to illustrate the alternative past and potential future trajectories of the pandemic.

Chapter 1. The economic impacts of the COVID-19 crisis. The COVID-19 pandemic sent shock waves through the world economy and triggered the largest global economic crisis in more than a century. The crisis led to a dramatic increase in inequality within and across countries.

The global economy is recovering slowly from the lockdowns. The recent World Economic Outlook (WEO) update, published in April 2021, estimates a partial recovery in 2021 with a baseline...

The prolonged economic disruption resulting from the COVID-19 pandemic is likely to lead to lower consumer and business confidence and decreased personal spending across a broad range of categories, with spillover effects for a multitude of other sectors.

The COVID-19 pandemic changed the relationship between the market economy, state, and society in the G7 countries and beyond. While economies collapsed due to the shutdown of broad swathes...

Using the OECD’s CGE model METRO, the paper finds that output declines observed in 2020 were driven primarily by reductions in labour productivity due to varying abilities to telework across countries. Negative economic impacts were largely mitigated by government support to firms and households.