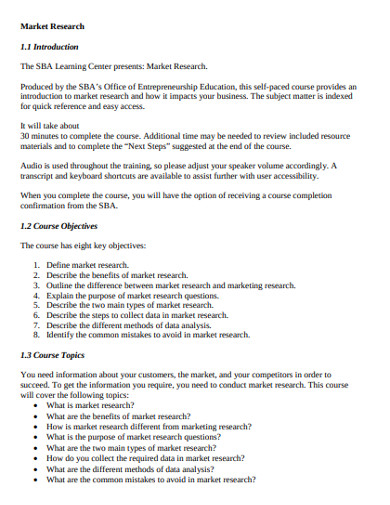

Market Research for a Business Plan: How to Do It in a Day

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

Whether it’s your first time using market research for a business plan or this isn’t exactly your first rodeo: a quick refresh on the topic can do no harm.

If anything, it’s the smart route to take. Particularly when you consider modern-day market research data can be obtained quicker than ever – when the right tools are used.

Today, I’m going to explain exactly how to conduct market research for a business plan, and how to access that key data and juicy intel without hassle.

The importance of market research in business planning

They say knowledge is power, and where your rivals and your market are concerned, there’s nothing quite like it. By looking at things like consumer behavior , the competitive landscape , market size, and the digital strategies of others; companies at any stage in their lifecycle can stay relevant, maintain a competitive edge, set strategic direction, and experience growth. Doing periodic market research also helps businesses develop a deeper, more informed understanding of a market, its audience, and key players. If you’re seeking financial backing, doing market research is essential to show credibility and build confidence in your plans.

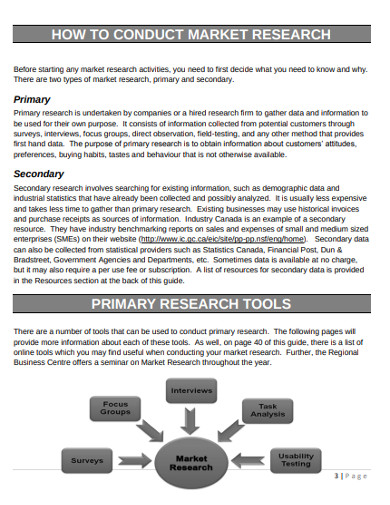

How to conduct market research for a business plan

Good market research for a business plan should be contextualized with information about your company, its goals, products, pricing, and financials. Sounds like a lot of work, right? Read on to learn how to conduct all the market research for a business plan you’re going to need – quickly, using the most up-to-date data there is. I’ll show you how to:

- Understand your audience

- Identify target personas

- Size your market

- Research the competition

- Discover your unique sales proposition

- Define marketing priorities

Before you start, make sure your business planning document includes the following 10 headings:

This format is considered best practice, so I’ve indicated the specific sections that each element of your market research fits into.

Sound good? Then let’s get started.

1. Understand your audience

What it is – A target audience is a social segment of people who are likely to be interested in your products or services. It’s a snapshot of your target customer base, sorted by certain characteristics. It’s also known as audience demographics and can contain data like age, gender, location, values, attitudes, behaviors, and more.

Where to use this market research in a business plan – Demographical data can help determine the size of your market, which slots into the executive summary, marketing plan, market sizing, and financial sections of the plan. What’s more, when you use it to identify groups of people to target, it can also be used in the products and services, competitive research tools , and SWOT analysis sections.

Bonus: Audience demographics can also help you develop stronger branding by choosing imagery that appeals most to your ideal customers.

How to do a quick audience analysis

Similarweb Research Intelligence gives you the ability to view almost any industry in a few seconds; you can also create a custom industry based on specific players in your market. Here’s how to see relevant audience demographics in a market. For this example, I chose the airline industry.

View typical audience relevant to your sector with gender and age distribution, along with geographical data . You can see which companies are experiencing growth and at what rate. Audience loyalty is also key to understanding how people behave, if they tend to shop around and what search terms they use to discover sites in any niche.

Read more: Learn more about how to do a demographic analysis of your market’s audience .

2. Identify target personas

What it is – An audience or target persona is a typical customer profile. It starts with audience demographics, and then zooms into a much deeper level. Most organizations develop multiple target personas, based on things like pain points, location, gender, background, occupation, influential factors, decision-making, likes, dislikes, goals, ideals, and more.

Pro Tip: If you’re in B2B, your target personas are based on the people who make purchasing decisions, not the business itself.

Where to use this market research in a business plan – Creating target personas for your business shows you know whom you’re targeting, and how to market to them. This information will help you complete market sizing, product or service overview, marketing plan , and could fit into the competitive research section too.

How to create a buyer persona in five steps

Guesswork does not equal less work – there’s no place for shortcuts here. Your success depends on developing the most accurate representation of who your customers are, and what they care about.

1. Research: If you’re already in business, use market research surveys as a tool to collect information about your customers. If you’re a startup or pre-startup, you can use a platform like Similarweb to establish a typical customer profile for your market. Don’t forget to use mobile app intelligence and website analytics in tandem to build a complete picture of your audience.

Pro Tip: Secondary market research is another good source of intel for startups. You might be able to find published surveys that relate to your products or market to learn more.

2. Analysis: Here, you’re looking to answer key questions to fill in the blanks and build a complete picture of your ideal customer. Tools like Similarweb Digital Research Intelligence, Google Analytics, and competitors’ social media channels can help you find this out. Typical questions include:

- Where is your audience coming from?

- What channels do they use to find your site?

- Do they favor access via mobile site, app, or desktop?

- What are their demographics? Think age, job, salary, location, and gender.

3. Competitive market research: This shows you what marketing channels, referral partners, and keywords are sending traffic to businesses similar to yours When you combine this data with what you learned in sections 1 + 2, you are ready to build your personas.

4. Fill in a buyer persona template: We’ve done the hard work for you. Download a pre-made template below .

Further reading: The complete guide to creating buyer personas

3. Size your market

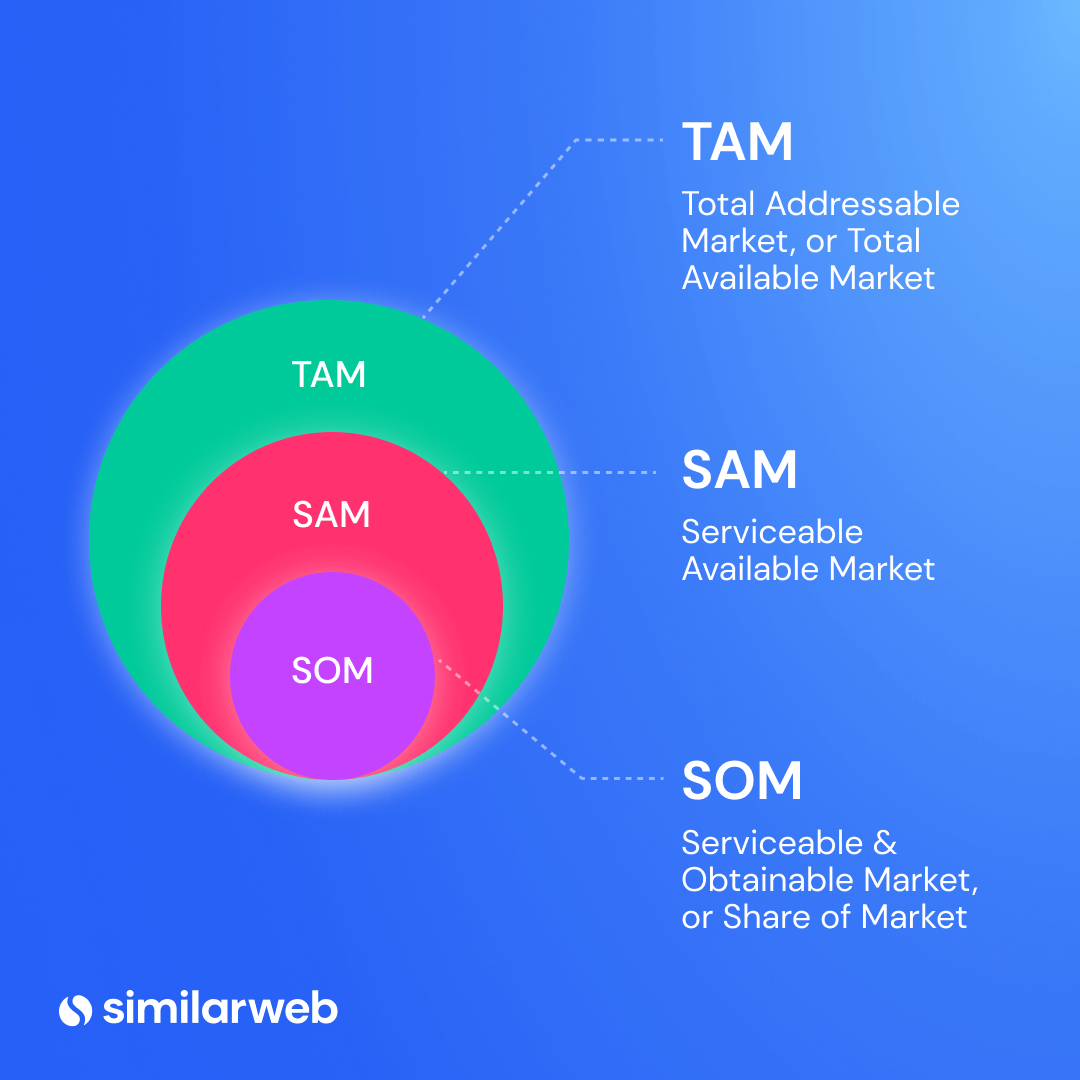

What it is – Market sizing is a way to determine the potential size of a target market using informed estimation. This is how you find out the potential revenue and market volume applicable to your business . There are three key metrics: total addressable market (TAM), service addressable market (SAM), and service obtainable market (SOM).

Where to use this market research in a business plan – Knowing how big the slice of the pie you’re going after is crucial. It can inform any goal setting and help with forecasting too. This data can be used in your executive summary, marketing plan, competitive research, SWOT analysis, market sizing, operations, and financial sections.

Further reading: How to do market sizing shows you how to calculate the TAM, SAM, and SOM for your business.

4. Research the competition

What it is – Competitive landscaping shows who you’re up against and how your offering stacks up vs others in your space. By evaluating rivals in-depth and looking at things like features, pricing, support, content, and additional products, you can form a detailed picture of the competition.

Where to use this market research in a business plan – The information you gain from performing a competitive analysis can transform what you offer and how you go to market. In business planning, this market research supports the executive summary, product or service overview, marketing plan, competitive research, SWOT analysis, and operation sections.

How to do competitive landscaping

Using the industry overview section of Similarweb Digital Research Intelligence, competitor research is made quick and easy. Access key metrics on an industry or specific players, then download raw data in a workable excel file or get a PNG image of charts in an instant. Most data can be downloaded via excel or as an image and included in the resource section of your plan.

Here, you can see a summary of a market, yearly growth, and top sites. A quick click to industry leaders shows you market leaders and rising stars. Select any name for a complete picture of their digital presence – use this to spot potential opportunities to gain a competitive advantage.

Read more: See how to do a competitive analysis and get a free template to help you get started.

5. Discover your unique sales proposition

What it is – Not all businesses have them, and that’s OK. A unique selling proposition (USP) is something distinctive your business offers but your rivals don’t . It can be anything that’s unique to a product, service, pricing model, or other.

Why it’s useful – Having a compelling USP helps your company stand out in a market. It can make your business more valuable to a customer vs the competition, and ultimately help you win and retain more customers.

Where to use this market research in a business plan – Your USP should be highlighted in the executive summary, the product and service overview, and the SWOT analysis.

How to find your USP

Unless you’ve developed a unique product or service, or you’re planning to sell to the market at a lower-than-average price point, you’re going to have to look for some kind of service differentiator that’ll help you stand out. In my experience, the quickest way to discover this is through competitive benchmarking. Here, I’m talking about evaluating your closest rivals to uncover things they’re not doing, or looking for gaps that your business can capitalize on.

A competitive review of their site should look at things like:

- Customer support: do they have live chat, email support, telephone support, etc.?

- Content: do they produce additional content that offers value, free resources, etc.?

- Offers: what promotions or offers do they run?

- Loyalty or referral programs: do they reward loyalty or referrals?

- Service level agreements: what commitments do they make to their customers?

- Operations: consider delivery methods, lead times, returns policy etc.

- Price promises: what satisfaction or price promises do they offer, if at all?

Go easy on yourself and create a basic template that details each point. Once complete, look for opportunities to provide something unique that nobody else currently offers.

6. Define marketing priorities

What it is – A detailed plan showing how you position and market your products or service. It should define realistic, clear, and measurable goals that articulate tactics, customer profiles, and the position of your products in the market.

Where to use this market research in a business plan – Relevant intel you uncover should inform the marketing plan first and foremost. However, it can also be used in the SWOT analysis, operation, and financial sections.

How to do it – with a market research example

Using the marketing channels within Similarweb Digital Research Intelligence, you can short-cut the lengthy (and often costly) process of trial and error when trying to decide which channels and activities work best.

Let me show you how.

Using Similarweb Digital Research Intelligence, I can hone in on any site I like, and look at key marketing intel to uncover the strategies they’re using, along with insights into what’s driving traffic, and traffic opportunities.

In less than 60 seconds, I can see easyJet’s complete online presence; its marketing and social channels, and a snapshot of every metric that matters, like referrals, organic and paid ads, keywords, and more. Expand any section to get granular data, and view insights that show exactly where key losses, gains, and opportunities exist.

You can take this a step further and add other sites into the mix. Compare sites side-by-side to see who is winning, and how they’re doing it. While this snapshot shows a comparison of a single competitor, you can compare five at any one time. What’s more, I can see industry leaders, rising players, and any relevant mobile app intelligence stats, should a company or its rivals have an app as part of their offering.

Best practice for market research data in business plans

When doing any type of market research , it’s important to use the most up-to-date data you can get your hands on. There are two key factors for data are timeliness and trustworthiness.

For any market, look for data that applies to any period over the last 12 months. With how fast markets evolve and how quickly consumer behaviors change, being able to view dynamic data is key. What’s more, the source of any data matters just as much as its age.

To emphasize the importance of using the right type of data in a business plan, here’s some timely advice from SBA commercial lending expert and VP of Commerce National Bank and Trust, Steve Fulmer. As someone who, in the past 15 years, has approved approximately $150 million in loans to SMBs; his advice is worth paying attention to.

“ For anybody doing market research for a business plan, they must cite sources. Most new or small businesses lack historical performance data, which removes substantial confidence in their plans. As a lender, we cannot support assumptions in their business plan or their projections if their data hasn’t come from a trustworthy source.”

Wrapping up…

Now you know the six ways to do market research for a business plan, it’s time to knuckle down and get started. With Similarweb, you’ve got access to all the market intel you’re going to need to conduct timely, accurate, and reliable market research. What’s more, you can return to the platform anytime to benchmark your performance , get fresh insights, and adapt your strategies to focus on growth – helping you build a sustainable business that can withstand the test of time.

How do I do market research for a business plan?

By using Digital Research Intelligence tools like Similarweb, you can quickly conduct audience research, company research, market analysis, and benchmarking from a single place. Another method is secondary market research, but this takes more time and data isn’t always up to date.

Why does a business plan need market research?

Doing market research for a business plan is the quickest and easiest way to validate a business idea and establish a clear view of the market and competitive landscape. When done right, it can show you opportunities for growth, strategies to avoid, and effective ways to market your business.

What is market research in a business plan?

Market research in business planning is one of the most powerful tools you can use to flesh out and validate your company or its products. It can tell you whether there’s a market for your product, and how big that market is – it also helps you discover industry trends, and examine the strategies of the rising stars and industry leaders in detail.

by Liz March

Digital Research Specialist

Liz March has 15 years of experience in content creation. She enjoys the outdoors, F1, and reading, and is pursuing a BSc in Environmental Science.

Related Posts

Competitive Matrix Types: Which Is Right For You?

Nail Your Market Positioning: A Go-To Guide for Standing Out

Ecommerce Market Research: Your Secret Weapon for Online Success

A Guide to Market Research Terminology For Beginners

Consumer Profiling: Targeting Your Ideal Customer

Market Opportunities: How to Identify and Analyze Them

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

- Starting a Business

Our Top Picks

- Best Small Business Loans

- Best Business Internet Service

- Best Online Payroll Service

- Best Business Phone Systems

Our In-Depth Reviews

- OnPay Payroll Review

- ADP Payroll Review

- Ooma Office Review

- RingCentral Review

Explore More

- Business Solutions

- Entrepreneurship

- Franchising

- Best Accounting Software

- Best Merchant Services Providers

- Best Credit Card Processors

- Best Mobile Credit Card Processors

- Clover Review

- Merchant One Review

- QuickBooks Online Review

- Xero Accounting Review

- Financial Solutions

Human Resources

- Best Human Resources Outsourcing Services

- Best Time and Attendance Software

- Best PEO Services

- Best Business Employee Retirement Plans

- Bambee Review

- Rippling HR Software Review

- TriNet Review

- Gusto Payroll Review

- HR Solutions

Marketing and Sales

- Best Text Message Marketing Services

- Best CRM Software

- Best Email Marketing Services

- Best Website Builders

- Textedly Review

- Salesforce Review

- EZ Texting Review

- Textline Review

- Business Intelligence

- Marketing Solutions

- Marketing Strategy

- Public Relations

- Social Media

- Best GPS Fleet Management Software

- Best POS Systems

- Best Employee Monitoring Software

- Best Document Management Software

- Verizon Connect Fleet GPS Review

- Zoom Review

- Samsara Review

- Zoho CRM Review

- Technology Solutions

Business Basics

- 4 Simple Steps to Valuing Your Small Business

- How to Write a Business Growth Plan

- 12 Business Skills You Need to Master

- How to Start a One-Person Business

- FreshBooks vs. QuickBooks Comparison

- Salesforce CRM vs. Zoho CRM

- RingCentral vs. Zoom Comparison

- 10 Ways to Generate More Sales Leads

Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here .

How to Create a Market Research Plan

Before starting a business, you want to fully research your idea. A market research plan will help you understand your competition, the marketplace and more.

Table of Contents

While having a great idea is an important part of establishing a business, you’ll only get so far without laying the proper groundwork. To help your business take off, not only do you need to size up the competition, but you also need to identify who will buy your product, how much it will cost, the best approach to selling it and how many people will demand it.

To get answers to these questions, you’ll need a market research plan, which you can create yourself or pay a specialist to create for you. Market research plans define an existing problem and/or outline an opportunity. From there, the marketing strategy is broken down task by task. Your plan should include objectives and the methods that you’ll use to achieve those objectives, along with a time frame for completing the work.

What should a market research plan include?

A market research plan should provide a thorough examination of how your product or service will fare in a defined area. It should include:

- An examination of the current marketplace and an analysis of the need for your product or service: To know where you fit in the market, it’s important to have a broad understanding of your industry — covering everything from its annual revenue to the industry standards to the total number of businesses operating within it. Start by gathering statistical data from sources like the U.S. Bureau of Labor Statistics and BMI Research and consider the industry’s market size, potential customer base and how external factors such as laws, technology, world events and socioeconomic changes impact it.

- An assessment of the competition: By analyzing your competitors, you can discover strategies to fill market gaps. This involves identifying well-known competitors and noting trends they employ successfully, scrutinizing customer feedback about businesses in your sector, such as through online reviews, and understanding competitors’ product or service offerings. This knowledge can then guide the refinement of your own products or services to differentiate them from others in the market.

- Data about customers: Identify which segment of potential customers in your industry you can effectively target, considering their demographics — such as age, ethnicity, income and location and psychographics, including beliefs, values and lifestyle. Learn about the challenges your customers face in their daily lives and determine how the features and benefits of your offerings address their needs.

- The direction for your marketing in the upcoming year: Your plan should provide a clear roadmap for your marketing strategies for the next year, focusing on approaches to distinguish your brand from competitors. Develop marketing messages that resonate with and display empathy toward your target market and find ways to address customers’ needs and demonstrate value.

- Goals to be met: Outline goals your business would like to achieve and make these goals clear to all employees on your team. Create goals that are realistic and attainable while also making a meaningful impact on the business’s growth. Consider factors including your target number of products or services, the expected number of units to sell based on market size, target market behavior, pricing for each item and the cost of production and advertising.

How to create your market research plan

Doing business without having a marketing plan is like driving without directions. You may eventually reach your destination, but there will be many costly and time-consuming mistakes made along the way.

Many entrepreneurs mistakenly believe there is a big demand for their service or product but, in reality, there may not be, your prices may be too high or too low or you may be going into a business with so many restrictions that it’s almost impossible to be successful. A market research plan will help you uncover significant issues or roadblocks.

Step 1. Conduct a comprehensive situation analysis.

One of the first steps in constructing your marketing plan is to create a strengths, weaknesses, opportunities and threats (SWOT) analysis , which is used to identify your competition, to know how they operate and then to understand their strengths and weaknesses.

Step 2: Develop clear marketing objectives.

In this section, describe the desired outcome for your marketing plan with realistic and attainable objectives, the targets and a clear and concise time frame. The most common way to approach this is with marketing objectives, which may include the total number of customers and the retention rate, the average volume of purchases, total market share and the proportion of your potential market that makes purchases.

Step 3: Make a financial plan.

A financial plan is essentia l for creating a solid marketing plan. The financial plan answers a range of questions that are critical components of your business, such as how much you intend to sell, what will you charge, how much will it cost to deliver your services or produce your products, how much will it cost for your basic operating expenses and how much financing will you need to operate your business.

In your business plan, be sure to describe who you are, what your business will be about, your business goals and what your inspiration was to buy, begin or grow your business.

Step 4: Determine your target audience.

Once you know what makes you stand out from your competitors and how you’ll market yourself, you should decide who to target with all this information. That’s why your market research plan should delineate your target audience. What are their demographics and how will these qualities affect your plan? How do your company’s current products and services affect which consumers you can realistically make customers? Will that change in the future? All of these questions should be answered in your plan.

Step 5: List your research methods.

Rarely does one research avenue make for a comprehensive market research plan. Instead, your plan should indicate several methods that will be used to determine the market share you can realistically obtain. This way, you get as much information as possible from as many sources as possible. The result is a more robust path toward establishing the exact footprint you desire for your company.

Step 6: Establish a timeline.

With your plan in place, you’ll need to figure out how long your market research process will take. Project management charts are often helpful in this regard as they divide tasks and personnel over a timeframe that you have set. No matter which type of project management chart you use, try to build some flexibility into your timeframe. A two-week buffer toward the home stretch comes in handy when a process scheduled for one week takes two — that buffer will keep you on deadline.

Step 7: Acknowledge ethical concerns.

Market research always presents opportunities for ethical missteps. After all, you’ll need to obtain competitor information and sensitive financial data that may not always be readily available. Your market research plan should thus encourage your team to not take any dicey steps to obtain this information. It may be better to state, “we could not obtain this competitor information,” than to spy on the competitor or pressure their current employees for knowledge. Plus, there’s nothing wrong with simply feeling better about the final state of your plan and how you got it there.

Using a market research firm

If the thought of trying to create your own market research plan seems daunting or too time-consuming, there are plenty of other people willing to do the work for you.

Pros of using a market research firm

As an objective third party, businesses can benefit from a market research firm’s impartial perspective and guidance, helping to shape impactful brand strategies and marketing campaigns. These firms, which can help businesses with everything from their marketing campaigns to brand launches, deliver precise results, drawing on their expertise and experience to provide in-depth insights and solutions tailored specifically to your company’s needs.

Even more, working with a market research firm can elevate a brand above the competition, as they provide credible and unique research that is highly valued by the media, enhancing brand credibility and potentially increasing website traffic, social media shares and online visibility.

Cons of using a market research firm

Although hiring a firm can provide businesses with tremendous results, certain downsides can lead a business toward the do-it-yourself route. Most notably, market research firms can be a costly expense that some businesses can’t afford. However, businesses that can allocate the funds will likely see a positive return on investment, as they are paying for the expertise and proficiency of seasoned professionals in the field.

Additionally, finding the right market research firm for your business’s needs can take some time — and even longer, ranging from weeks to months, for a market research firm to complete a plan. This lack of immediate results can be detrimental for businesses that don’t have the time to wait.

Market research firms can charge into the thousands of dollars for a market research plan, but there are ways to get help more affordably, including:

- Outline your plans carefully and spell out objectives.

- Examine as many sources as possible.

- Before paying for any information, check with librarians, small business development centers or market research professors to see if they can help you access market research data for free.

- You may think you’ll need to spend a hefty sum to create a market research plan, but there are plenty of free and low-cost sources available, especially through university business schools that will guide you through the process.

Miranda Fraraccio contributed to this article.

Get Weekly 5-Minute Business Advice

B. newsletter is your digest of bite-sized news, thought & brand leadership, and entertainment. All in one email.

Our mission is to help you take your team, your business and your career to the next level. Whether you're here for product recommendations, research or career advice, we're happy you're here!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

Market Research: A How-To Guide and Template

Discover the different types of market research, how to conduct your own market research, and use a free template to help you along the way.

MARKET RESEARCH KIT

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

Updated: 02/21/24

Published: 03/30/16

Today's consumers have a lot of power. As a business, you must have a deep understanding of who your buyers are and what influences their purchase decisions.

Enter: Market Research.

![market research in business plan → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Whether you're new to market research or not, I created this guide to help you conduct a thorough study of your market, target audience, competition, and more. Let’s dive in.

Table of Contents

What is market research?

Primary vs. secondary research, types of market research, how to do market research, market research report template, market research examples.

Market research is the process of gathering information about your target market and customers to verify the success of a new product, help your team iterate on an existing product, or understand brand perception to ensure your team is effectively communicating your company's value effectively.

Market research can answer various questions about the state of an industry. But if you ask me, it's hardly a crystal ball that marketers can rely on for insights on their customers.

Market researchers investigate several areas of the market, and it can take weeks or even months to paint an accurate picture of the business landscape.

However, researching just one of those areas can make you more intuitive to who your buyers are and how to deliver value that no other business is offering them right now.

How? Consider these two things:

- Your competitors also have experienced individuals in the industry and a customer base. It‘s very possible that your immediate resources are, in many ways, equal to those of your competition’s immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your customers don't represent the attitudes of an entire market. They represent the attitudes of the part of the market that is already drawn to your brand.

The market research services market is growing rapidly, which signifies a strong interest in market research as we enter 2024. The market is expected to grow from roughly $75 billion in 2021 to $90.79 billion in 2025 .

.png)

Free Market Research Kit

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Why do market research?

Market research allows you to meet your buyer where they are.

As our world becomes louder and demands more of our attention, this proves invaluable.

By understanding your buyer's problems, pain points, and desired solutions, you can aptly craft your product or service to naturally appeal to them.

Market research also provides insight into the following:

- Where your target audience and current customers conduct their product or service research

- Which of your competitors your target audience looks to for information, options, or purchases

- What's trending in your industry and in the eyes of your buyer

- Who makes up your market and what their challenges are

- What influences purchases and conversions among your target audience

- Consumer attitudes about a particular topic, pain, product, or brand

- Whether there‘s demand for the business initiatives you’re investing in

- Unaddressed or underserved customer needs that can be flipped into selling opportunity

- Attitudes about pricing for a particular product or service

Ultimately, market research allows you to get information from a larger sample size of your target audience, eliminating bias and assumptions so that you can get to the heart of consumer attitudes.

As a result, you can make better business decisions.

To give you an idea of how extensive market research can get , consider that it can either be qualitative or quantitative in nature — depending on the studies you conduct and what you're trying to learn about your industry.

Qualitative research is concerned with public opinion, and explores how the market feels about the products currently available in that market.

Quantitative research is concerned with data, and looks for relevant trends in the information that's gathered from public records.

That said, there are two main types of market research that your business can conduct to collect actionable information on your products: primary research and secondary research.

Primary Research

Primary research is the pursuit of first-hand information about your market and the customers within your market.

It's useful when segmenting your market and establishing your buyer personas.

Primary market research tends to fall into one of two buckets:

- Exploratory Primary Research: This kind of primary market research normally takes place as a first step — before any specific research has been performed — and may involve open-ended interviews or surveys with small numbers of people.

- Specific Primary Research: This type of research often follows exploratory research. In specific research, you take a smaller or more precise segment of your audience and ask questions aimed at solving a suspected problem.

Secondary Research

Secondary research is all the data and public records you have at your disposal to draw conclusions from (e.g. trend reports, market statistics, industry content, and sales data you already have on your business).

Secondary research is particularly useful for analyzing your competitors . The main buckets your secondary market research will fall into include:

- Public Sources: These sources are your first and most-accessible layer of material when conducting secondary market research. They're often free to find and review — like government statistics (e.g., from the U.S. Census Bureau ).

- Commercial Sources: These sources often come in the form of pay-to-access market reports, consisting of industry insight compiled by a research agency like Pew , Gartner , or Forrester .

- Internal Sources: This is the market data your organization already has like average revenue per sale, customer retention rates, and other historical data that can help you draw conclusions on buyer needs.

- Focus Groups

- Product/ Service Use Research

- Observation-Based Research

- Buyer Persona Research

- Market Segmentation Research

- Pricing Research

- Competitive Analysis Research

- Customer Satisfaction and Loyalty Research

- Brand Awareness Research

- Campaign Research

1. Interviews

Interviews allow for face-to-face discussions so you can allow for a natural flow of conversation. Your interviewees can answer questions about themselves to help you design your buyer personas and shape your entire marketing strategy.

2. Focus Groups

Focus groups provide you with a handful of carefully-selected people that can test out your product and provide feedback. This type of market research can give you ideas for product differentiation.

3. Product/Service Use Research

Product or service use research offers insight into how and why your audience uses your product or service. This type of market research also gives you an idea of the product or service's usability for your target audience.

4. Observation-Based Research

Observation-based research allows you to sit back and watch the ways in which your target audience members go about using your product or service, what works well in terms of UX , and which aspects of it could be improved.

5. Buyer Persona Research

Buyer persona research gives you a realistic look at who makes up your target audience, what their challenges are, why they want your product or service, and what they need from your business or brand.

6. Market Segmentation Research

Market segmentation research allows you to categorize your target audience into different groups (or segments) based on specific and defining characteristics. This way, you can determine effective ways to meet their needs.

7. Pricing Research

Pricing research helps you define your pricing strategy . It gives you an idea of what similar products or services in your market sell for and what your target audience is willing to pay.

8. Competitive Analysis

Competitive analyses give you a deep understanding of the competition in your market and industry. You can learn about what's doing well in your industry and how you can separate yourself from the competition .

9. Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research gives you a look into how you can get current customers to return for more business and what will motivate them to do so (e.g., loyalty programs , rewards, remarkable customer service).

10. Brand Awareness Research

Brand awareness research tells you what your target audience knows about and recognizes from your brand. It tells you about the associations people make when they think about your business.

11. Campaign Research

Campaign research entails looking into your past campaigns and analyzing their success among your target audience and current customers. The goal is to use these learnings to inform future campaigns.

- Define your buyer persona.

- Identify a persona group to engage.

- Prepare research questions for your market research participants.

- List your primary competitors.

- Summarize your findings.

1. Define your buyer persona.

You have to understand who your customers are and how customers in your industry make buying decisions.

This is where your buyer personas come in handy. Buyer personas — sometimes referred to as marketing personas — are fictional, generalized representations of your ideal customers.

Use a free tool to create a buyer persona that your entire company can use to market, sell, and serve better.

10 Free Competitive Analysis Templates

Track and analyze your competitors with these ten free planning templates.

- SWOT Analysis

- Battle Cards

- Feature Comparison

- Strategic Overview

Identifying Content Competitors

Search engines are your best friends in this area of secondary market research.

To find the online publications with which you compete, take the overarching industry term you identified in the section above, and come up with a handful of more specific industry terms your company identifies with.

A catering business, for example, might generally be a “food service” company, but also consider itself a vendor in “event catering,” “cake catering,” or “baked goods.” Once you have this list, do the following:

- Google it. Don't underestimate the value in seeing which websites come up when you run a search on Google for the industry terms that describe your company. You might find a mix of product developers, blogs, magazines, and more.

- Compare your search results against your buyer persona. If the content the website publishes seems like the stuff your buyer persona would want to see, it's a potential competitor, and should be added to your list of competitors.

5. Summarize your findings.

Feeling overwhelmed by the notes you took? We suggest looking for common themes that will help you tell a story and create a list of action items.

To make the process easier, try using your favorite presentation software to make a report, as it will make it easy to add in quotes, diagrams, or call clips.

Feel free to add your own flair, but the following outline should help you craft a clear summary:

- Background: Your goals and why you conducted this study.

- Participants: Who you talked to. A table works well so you can break groups down by persona and customer/prospect.

- Executive Summary : What were the most interesting things you learned? What do you plan to do about it?

- Awareness: Describe the common triggers that lead someone to enter into an evaluation. (Quotes can be very powerful.)

- Consideration: Provide the main themes you uncovered, as well as the detailed sources buyers use when conducting their evaluation.

- Decision: Paint the picture of how a decision is really made by including the people at the center of influence and any product features or information that can make or break a deal.

- Action Plan: Your analysis probably uncovered a few campaigns you can run to get your brand in front of buyers earlier and/or more effectively. Provide your list of priorities, a timeline, and the impact it will have on your business.

Within a market research kit, there are a number of critical pieces of information for your business‘s success. Let’s take a look at these elements.

Pro Tip: Upon downloading HubSpot's free Market Research Kit , you'll receive editable templates for each of the given parts of the kit, instructions on how to use the kit, and a mock presentation that you can edit and customize.

What Is a Competitive Analysis — and How Do You Conduct One?

![market research in business plan The Beginner's Guide to the Competitive Matrix [+ Templates]](https://www.hubspot.com/hubfs/competitive-matrix-1-20240828-9831599.webp)

The Beginner's Guide to the Competitive Matrix [+ Templates]

What is a Competitive Analysis — and How Do You Conduct One?

![market research in business plan 9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]](https://www.hubspot.com/hubfs/marketing-research-methods-featured.png)

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

![market research in business plan SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![market research in business plan How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research in business plan 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Build A Profitable EComm Business For Just $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

7 Steps to Finding Your Brand Tone of Voice

5 Ways to Leverage Customer Reviews to Increase Sales

Brand Authenticity: How User-Generated Content Can Give You a Much-Needed Boost

5 Ways Personalization in eCommerce Can Enhance Customer Experience

Engaging Your Audience with Social Media Quizzes and Polls

Email Marketing Automation: Tools and Strategies for 2024

How to Find Influencers: 6 Ways to Discover Your Perfect Brand Advocate

How to Create a Marketing Plan In 2024 (Template + Examples)

What Is UGC and Why It’s a Must-Have for Your Brand

Ad Expert Phoenix Ha on How to Make Creative Ads without Breaking Your Budget

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

Accelerate Your Ecommerce Journey for Just $1

Step-by-Step Guidance from World-Class Entrepreneurs to Build, Grow, and Scale Your Ecommerce Brand

Don't Miss Out! Get Instant Access to foundr+ for Just $1!

1000+ lessons. customized learning. 30,000+ strong community..

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.