How to Write a Competitive Analysis: a Comprehensive Guide

- September 4, 2024

Writing a competitive analysis is like mapping out the playing field of your business. It helps you see who you’re up against, what you’re doing well, and where you could do better.

Whether you’re just starting or looking for ways to grow, understanding your competition is crucial. Let’s dive into how you can get a clear picture of your competition, and how to use it in your business plan.

What is a Competitive Analysis?

A competitive analysis is a comprehensive evaluation designed to assess the competitive landscape in which a business operates. It involves identifying your main competitors and critically analyzing their strategies, strengths, weaknesses, products, services, and market positioning.

The purpose of this analysis is not only to understand who your competitors are but also to evaluate how they meet their customers’ needs and how your offerings compare.

Key Components:

Here are the key components we include in a competitive analysis:

- Competitor Identification : Begins with identifying both direct competitors (those offering similar products or services) and indirect competitors (those offering alternative solutions to the same customer needs).

- Product and Service Comparison : Involves comparing your products and services against those of your competitors to identify similarities, differences, advantages, and disadvantages.

- Market Positioning : Examines how each competitor positions themselves in the market, including their marketing strategies , target audiences, and brand messaging.

- Strengths and Weaknesses : Assesses the internal factors that contribute to competitors’ success or shortcomings, such as proprietary technology, brand reputation, financial resources, and operational efficiencies.

- Opportunities and Threats : Identifies external factors that could represent opportunities or threats to your competitors, providing insights into potential market shifts, regulatory changes, technological advancements, and evolving customer preferences.

- Customer Base Analysis : Looks at the type of customers your competitors are attracting, their loyalty programs, customer service strategies, and feedback channels.

Why Do We Conduct Competitive Analysis?

The primary purpose of a competitive analysis is to equip businesses with the knowledge to make strategic decisions that enhance their competitive advantage. It helps in:

- Differentiation : Understanding what competitors offer allows a business to differentiate its products or services more effectively, highlighting unique features or benefits that address gaps in the market.

- Strategy Development : Insights gained can inform strategic decisions around marketing, sales, product development, and customer service, ensuring they are tailored to outmaneuver competitors.

- Anticipating Competitor Moves : By analyzing competitors’ strengths and weaknesses, businesses can better anticipate future moves, whether it’s a new product launch, market expansion, or pricing strategy .

- Market Trends Identification : Keeps businesses informed about broader market trends and customer preferences, ensuring they remain relevant and responsive to market demands.

- Risk Mitigation : Identifying threats in the competitive landscape allows businesses to develop contingency plans to address potential challenges proactively.

Why Do We Use a Competitive Analysis in a Business Plan?

We use a competitive analysis in a business plan for several key reasons:

- Market Understanding : It helps to gain a deep understanding of the market dynamics, including how saturated the market is, what the competitors offer, and where there might be gaps in the market.

- Strategic Positioning : By identifying your competitors’ strengths and weaknesses, you can better position your own business to compete effectively. It allows you to highlight what makes your business unique and attractive to potential customers.

- Opportunity Identification : Competitive analysis can reveal market trends and shifts that present new opportunities for your business, whether through innovation, market expansion, or diversification.

- Risk Management : Understanding the competitive landscape helps in anticipating potential threats and challenges your business might face, allowing you to develop strategies to mitigate these risks.

- Investor Confidence : Including a competitive analysis in your business plan demonstrates to investors and stakeholders that you have a realistic grasp of your industry and are aware of the competitive challenges. It reassures them that you are prepared to navigate these challenges effectively.

- Informed Decision Making : The insights gained from a competitive analysis can inform various aspects of your business strategy, from marketing and pricing to product development and customer service. This ensures that decisions are made based on a comprehensive understanding of the competitive environment.

How to Conduct a Competitive Analysis?

Preparing a competitive analysis involves several structured steps to ensure a comprehensive understanding of your competitive landscape. Here’s how to go about it:

1. Identify Your Competitors

- Direct Competitors : These businesses offer the same products or services as you do to the same target market .

- Indirect Competitors : These businesses offer different products or services that satisfy the same customer needs as yours.

Start with a broad list and then narrow it down to the most significant competitors for a detailed analysis.

2. Gather Information

Collect data on your identified competitors. Useful sources include:

- Competitors’ websites and social media profiles

- Customer reviews and feedback on platforms like Yelp, Google, or industry-specific forums

- Industry reports and market analysis documents

- Press releases and news articles

Look for information on their products, services, pricing, marketing strategies, target customers , market share, and any other relevant data.

3. Analyze Their Offerings

Compare your competitors’ products or services to your own. Consider:

- The range of products or services offered

- Quality and pricing

- Unique features or benefits

- Customer service and support

- Branding and marketing strategies

4. Evaluate Their Strengths and Weaknesses

Based on the information gathered, assess each competitor’s strengths and weaknesses. Consider their operational efficiency, customer loyalty, market positioning, innovation capabilities, and financial stability.

5. Identify Opportunities and Threats

From your analysis, determine:

- Opportunities : Areas where your competitors are not meeting customer needs effectively, market segments they are overlooking, or strategic alliances they haven’t formed.

- Threats : Competitors’ strategies that could pose a challenge to your business, such as aggressive pricing, new product launches, or market expansion plans.

6. Assess Their Marketing Strategies

Look at how your competitors are marketing their products or services:

- Which channels are they using? (e.g., social media, email marketing, SEO, PPC)

- What key messages are they conveying?

- How are they positioning their brand?

7. Summarize Your Findings

Create a detailed report summarizing your findings for each competitor, highlighting their key strengths, weaknesses, the opportunities they present to you, and the threats they pose.

Related Posts

The 10 Best Vending Machine Franchises of 2024 in the USA

- October 24, 2024

The 10 Best Sports Bar Franchises of 2024 in the US

- October 23, 2024

The 8 Best Tire Franchises of 2024 in the US

Privacy overview.

A Guide to Competitive Analysis: It’s Not Just about Competitors

By Joe Weller | April 16, 2018 (updated October 25, 2024)

- Share on Facebook

- Share on LinkedIn

Link copied

If you were running a cross-country marathon, wouldn’t you want to know something of the terrain and expected weather conditions before you began? The same principle of preparation applies when starting and continuing a business. It’s not enough to focus on your own production and financial goals: You need to understand what’s happening around you, how others create goods or services, the economic forecast, changes in rules and regulations, and more. In other words, you need to conduct a competitive analysis. The thought of searching for and digesting the required information may seem overwhelming, but we make it easy.

In this article, we explain how to focus your analysis by first deciding what questions you want answered. Learn how to find current and potential competitors and how many of them you need to review. Then, we cover the specific aspects of your competitors that you need to consider as well as where to find more information about them. Marketing experts weigh in on how to maintain focus during analysis. We also offer free, downloadable competitive analysis templates to start you on your own information gathering and analysis.

What Is Competitor Analysis?

Competitor analysis (CA) is a process of identifying competitors and gauging their business and marketing strategies to understand both their strengths and weaknesses and those of your own business. Competitive analysis provides a higher-level perspective of the entire marketing landscape and competitive intelligence.

“Competitive analysis is the process of analyzing all collected information to derive some insight for reducing risk and making better decisions,” explains competitive intelligence expert and author Babette Bensoussan .

“It is about your broader competitive environment,” she says. “I always remind my clients that competitors make up only one element of a business’s competitive environment. Other elements include government, technology, buyers, and suppliers, to name a few that impact how well you can compete.”

What Is the Purpose of a Competitive Analysis?

Researching your competitive landscape is essential to business growth and survival, and helps you offer better products or services to customers. You should gain an understanding of how customers view your company, what you’re doing right, and what you’re doing wrong. Therefore, competitive analysis forms a crucial part of marketing plans to help you understand what differentiates your product or service. Particularly when applying for funding, competitive analysis provides valuable insight into business plans. However, competitive analysis offers much more:

- Branding possibilities

- Insight into how competitors design products and messages

- SEO possibilities

- CRO (conversion rate optimization)

- GTM strategies

- User experience (UX) advantages of your and others’ products and websites

- Gaps in the market

- New products and services to develop

- Market trends

According to a Conductor survey , 60 percent of marketers don’t feel proficient in competitive analysis. Many don’t practice it on a regular basis. Knowledge derived from these exercises is critical, and you need to assess competition regularly. Nevertheless, marketing departments often skip competitive analysis, which leaves them with a fragmentary understanding of the landscape and competitors. Being proactive can help you anticipate and prepare for competitor developments and provide you with the agility to take advantage of changes.

According to Bensoussan, “In today’s world of constant change and information overload (whether the information be real or fake), it is critical for any business person to understand the competitive landscape and the forces that impact the profitability and viability of a business.”

What Should Be Included in a Competitive Analysis?

In most cases, a competitive analysis contains a few basic sections, which may vary depending on the size and form of your company and the focus of your analysis:

- A list of your main competitors

- An overview or what you know about them

- Who their target customers are

- A list of their products or services

- What media they use to market their goods and services

- Their current and past marketing strategies

- Their value proposition and effectiveness

- An analysis of all of the strengths and weaknesses of your competition (and your own company)

- An overview of the strategies being used by the competition to achieve their objectives

- An overview of the market and projections for the future

How to Prepare for a Competitive Analysis

One of the crucial prerequisites for a successful competitive analysis is an open mind. Check your beliefs at the door — what you think about your company, your customers, or your competitors isn’t necessarily true. That can be a good thing.

In addition, it is vital to understand why you are conducting an analysis. What are your goals for the business? What are your goals for this analysis? “Always, always be very clear as to what the decision you will be making is all about,” advises Bensoussan. “If you are not clear about your decision, then you will never know if you have good competitive analysis or just some more information.”

She offers these two questions as examples of how different the impact of each answer can be: “Tell me who’s who in the [manufacturing] of zippers?” versus “Should I enter the zipper-manufacturing industry, and can I achieve a return on investment of, say, 15 percent in three years?”

“Which question would help you the most in delivering good quality CA? Which outcome do you think would provide the most value?” Bensoussan asks.

Companies often enlist the help of outside consulting firms dedicated to conducting competitive intelligence research. Guidance on competitive intelligence support, such as database information, software platforms for market program tracking, and more is available through the Society of Competitive Intelligence Professionals .

Competitor Analysis Frameworks

Over the decades, marketing gurus have developed or advocated several competitive analysis frameworks. Here are six well-known methods to consider.

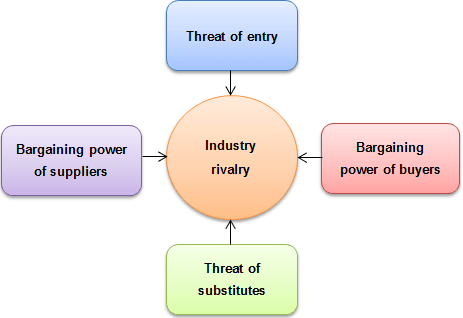

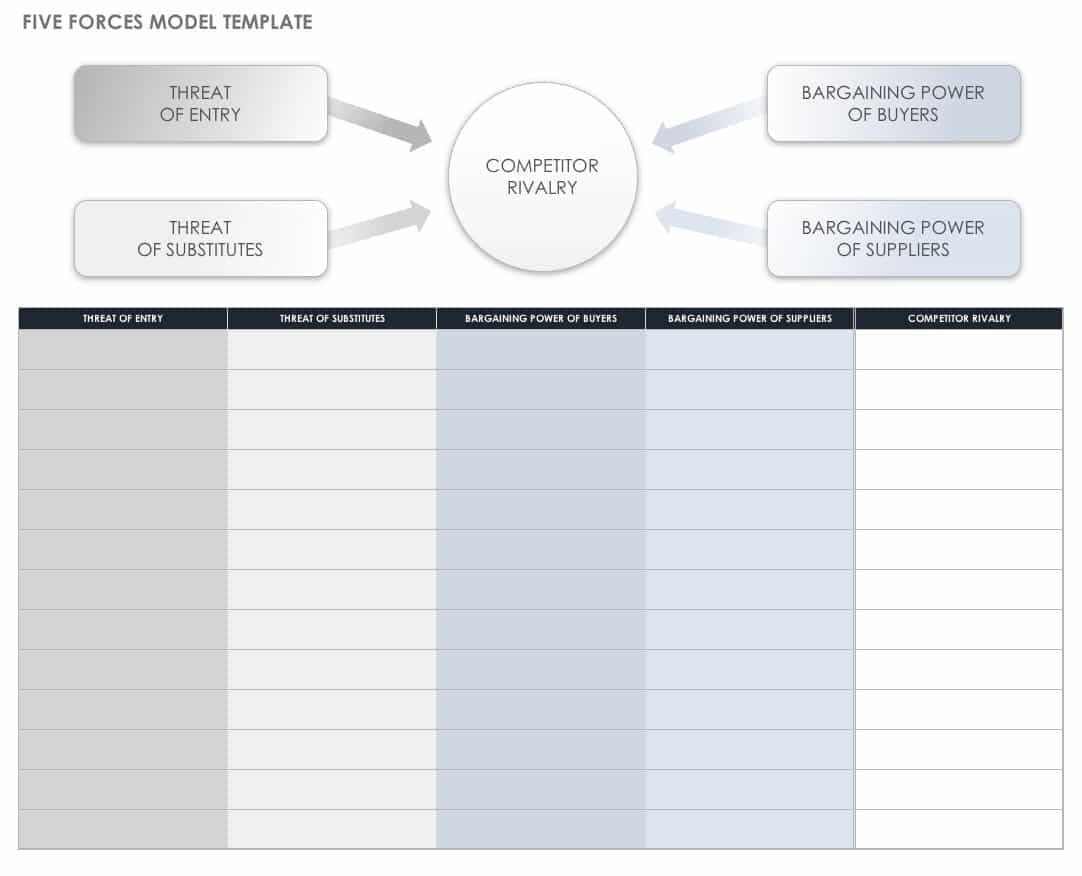

- Porter’s Five Forces Model: First published in 1979 by Harvard Business School professor Michael Porter, the Five Forces model provides a view beyond competitors to factors in your industry landscape that may threaten or strengthen your position. The Five Forces include the following:

- Potential New Entrants: Consider how much money, time, and effort it would take for a company to displace you.

- Competitive Rivalry: Determine who your competitors are, who the closest competitors are, and their products, prices, and quality. Fewer rivals mean more opportunity for your unique qualities to shine; many rivals mean more competitors to steal your customers and potentially better deals to lead customers elsewhere.

- Suppliers: The more potential suppliers you have, the better for you. Consider how having fewer suppliers might impact your operation.

- Buyers: If you have many customers, you have the power. Otherwise, buyers can negotiate more advantageous deals elsewhere or find sources other than yours. Consider how you would treat that situation.

- Substitutes (or Complements): A competitor could create a product or model that replaces yours. On the other hand, a new product or service could also complement yours, which would create a symbiotic sales situation. Complements are sometimes considered the sixth force in the model.

Porter stressed the importance of not confusing these constants with temporary disruptions, such as technological innovations or government interventions in industry.

You can download the Five Forces model below to answer your own questions about an industry or business proposition.

Download Five Forces Model

Excel | PDF

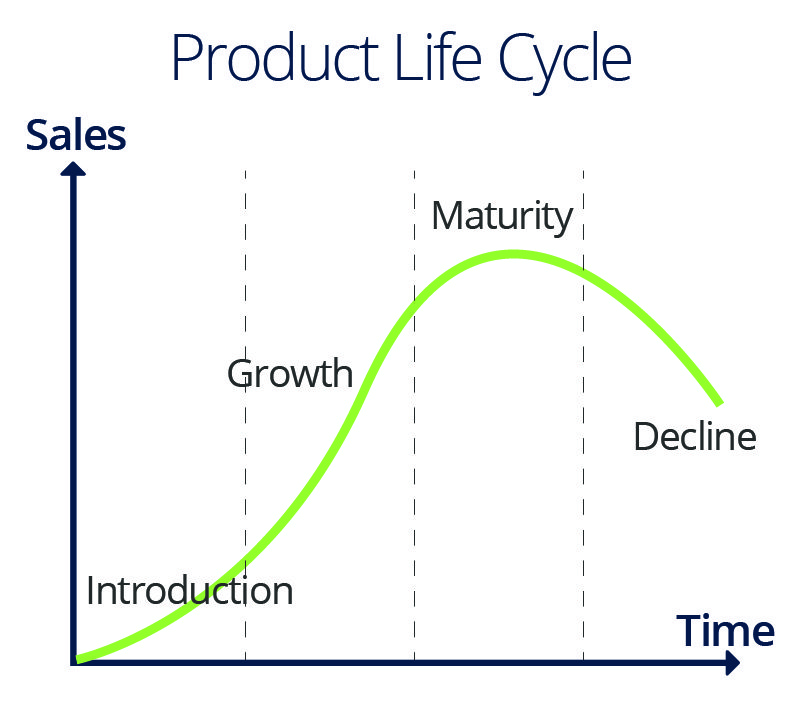

Industry Life Cycle Overview: Both industries and individual products have life cycles, which reflect the state of sales, whether robust or diminishing. Understand which stage of the life cycle your industry, company, or product is in to help target your marketing efforts. Product life cycles contain such stages as these:

- Introduction: At the introductory stage, a new industry or product is not well known or proven. It is usually marketed to a few early adopters. Because resources focus on product development, testing, and refinement, few or no profits accrue. Marketing focuses on explaining the product, creating awareness around it, and establishing a niche.

- Growth: As awareness grows and the industry or product becomes established, profits may also grow. However, in the growth stage, rival products may also appear. Although improvements require funds, production efficiencies may also develop. Some products have only a short growth phase. For example, a particular fashion may last for only one season. Other products experience a long or extended growth phase, such as software products, which continue their usefulness through upgrades. During the growth stage, marketing centers on differentiating the product, so it stands out from competing products.

- Maturity: In the maturity stage of a product or industry, sales may expand, but at a less accelerated rate. Fewer competitors may dominate the market and may attempt to differentiate on quality or increase sales by touting low costs.

- Saturation: You reach the saturation stage when every customer who could buy the product already owns the product. A lack of innovation or competition from a superior product could result in saturation.

- Decline/Termination: Industries and products decline for several reasons. Innovations may overtake them and render them obsolete. Businesses and product lines may fail to upgrade and innovate. At the decline or termination stage, companies may fold, continue in a smaller market, or merge with larger, successful businesses.

Strategic Groups Analysis: You perform strategic groups analysis on companies within a business sector, such as automobiles, to see how they vie for their share of consumer expenditure. By dividing companies into strategic groups, you can understand how businesses of different sizes behave in the marketing landscape. Businesses within groups tend to be competitors, whereas businesses in other groups are related but not competitive. For example, running shoes and high-end women’s dress shoes are in different groups. Analyzing companies in this way can also reveal other significant information: direct competitors and their basis for competition; if and how a company can move to another group; and strategic problems and opportunities. Strategic groups are usually plotted on an x-y axis, where two highly relevant criteria form the axes. Here are some examples of criteria:

- Brand ownership

- Company size

- Capacity utilization

- Cost structure

- Geographical market segmentation

- Marketing activities

- Ownership structure

- Sales channels

- Product diversity

- Product quality

- R&D capability

- Vertical and horizontal integration

First, plot the companies where you think they belong on the graph. Now, with all companies plotted, create groupings. If you want, you can use larger or smaller circles to indicate market share. To gain greater insight, perform a Five Forces analysis on them, or consider the mobility barriers that prevent companies from shifting to other strategic groups.

SWOT: Perhaps one of the most commonly addressed marketing analyses is SWOT (strengths, weaknesses, opportunities, and threats). In essence, SWOT represents what competitors do and do not do well. As you look at SWOT for competitors, also consider it for your own products and services.

- Strengths: What do they do better than you? What are they known for? Is their pricing, inventory, convenience, and level of service better than yours?

- Weaknesses: How do they fall short of your company’s standards? Can you leverage their shortcomings to improve your standing with customers?

- Opportunities: What in your competitors’ landscape can you exploit to your advantage?

- Threats: What in your competitors’ landscape threatens their business position?

Note that strengths and weaknesses focus on internal characteristics, while opportunities and threats concern external forces. SWOT can be performed separately, but it may provide a useful frame for studying a business’ products and services, marketing, and sales.

Competitive Array: Competitive arrays, also known as competitive matrices , provide a way to quantify characteristics that may be unquantifiable. For example, if company A sells 500 widgets and company B sells 250, it’s clear which company sold more. But how do you quantify the attractiveness of online and print media or innovation? Creating the competitive array can be an individual or group exercise. To start, list your competitors across the top of your writing surface. In the left-most column, list important characteristics. Next, create a column for weighting the importance of each characteristic so that the sum of the characteristics totals one. The higher the weighting, the more important the characteristic (you may have a few characteristics with the same weight). Next, grade each competitor for each characteristic on a scale, such as from one to 10. Now, multiply the grade by the corresponding weight.

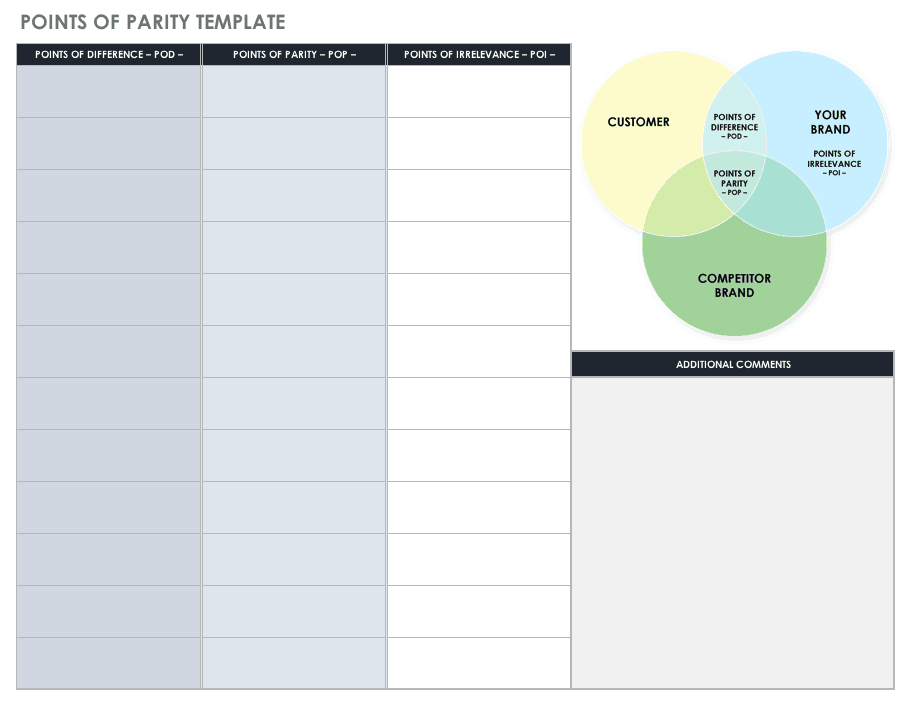

Competitive Value Proposition Analysis: The characteristics of a value proposition are exclusivity, clarity, and credibility. This method concerns how unique the product or service is, how clearly the product message is conveyed, and whether the message is credibly supported by evidence, such as testimonials, statistics, or test results. Because customers remember only a few key advantages of your product from your media promotion, the main value proposition must be correct and clear and mesh with your actual competitive advantage. To figure out how to differentiate your company, you must determine how competitors differentiate themselves from each other. POPs (points of parity), PODs (points of difference), and POIs (points of irrelevance) help you dissect value propositions.

- Points of Parity (POPs): These are elements of customer benefit that both you and your competitors offer.

- Points of Difference (PODs): These are features of customer benefit that you offer but competitors don’t. Keep in mind that not every point of difference is significant to consumers.

- Points of Irrelevance (POIs): These are characteristics that customers don’t care about.

Your unique value proposition (differentiating characteristics) doesn’t need to appeal to every customer. Don’t make your value proposition too general. You can’t be all things to all customers, just as you can’t do what your competitors are doing.

Otherwise, there's no differentiation. You end up being like teenagers, everybody in the same jeans," says Sonia Schechter, Chief Marketing Officer of Marxent , a provider of virtual reality and augmented reality apps for furniture retailers. Therefore, target your message.

Discover your points of parity by using our POP template.

Download Points of Parity Template

Excel | Word | PDF

Who Are Your Competitors?

As a first step in competitive analysis, marketing guides typically suggest determining who your competitors are. Competitors can be divided into groups of direct competitors, indirect competitors, and future competitors.

- Direct Competitor: These are companies who sell a direct substitute for your product, operate in the same geographic area, and/or offer the same goods (such as groceries) to the same market. Ask who your customers would buy from if you weren’t in business.

- Indirect Competitor: These are companies in the same geographic area whose products occupy the same general, but not specific, category as your own (e.g., a general bakery versus a designer cake store). Indirect competition satisfies the customer’s need for a particular product or service, although that product or service may be different from yours. Similar products operating in different market segments do not represent direct competitors. For example, a high-end seafood restaurant doesn’t compete with a burger place.

- Future Competitor: Future competitors may currently be indirect competitors who change and expand solutions. In the bakery example, the general bakery could hire a high-end designer to compete with the specialty cake maker. Or, the designer cake store could branch out into breads and muffins.

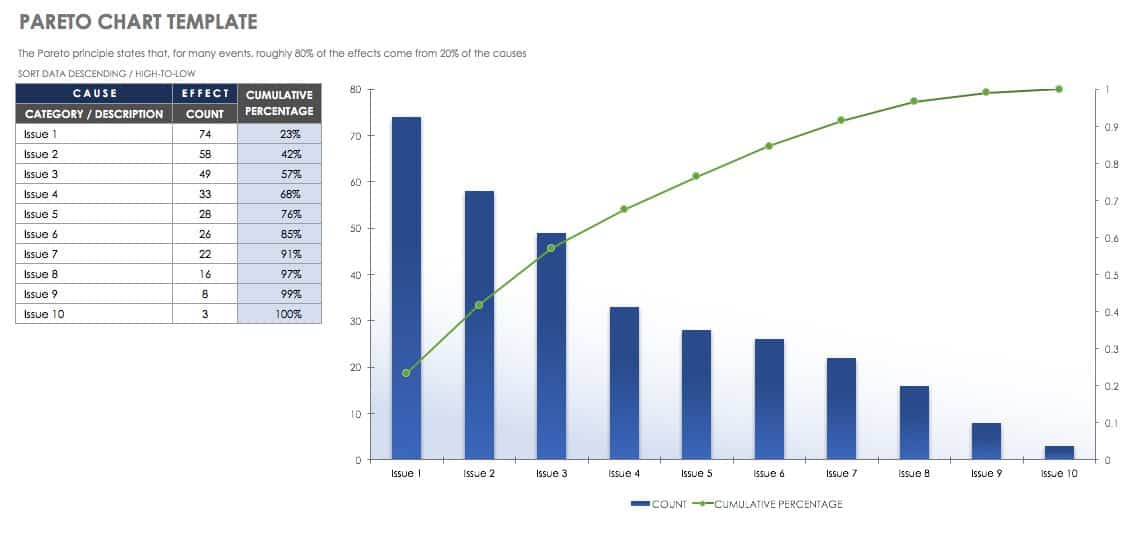

It may be difficult at first to envision what types of organizations you need to analyze and whether you need to analyze all competitors.To identify competitors, ask yourself who your customers would buy from if your product did not exist. Perhaps even more important, consider who your customers think your competitors are. How many competitors you review depends: If only a few companies do what you do, analyze everyone. If you have many competitors, use Pareto analysis to focus on the critical 20 percent. Larger businesses may analyze the top 10, whereas a small business can focus on three. Disregard online competitors unless you plan to sell online.

Download Pareto Chart Template - Excel

How to Find Current Competitors

Some competitors may seem obvious, but sleuthing can reveal challengers you weren’t aware of.

- Google search for a product or service similar to yours. Consider the companies in paid ads and organic returns.

- Try SEMrush to check which domains are using which keywords.

- Ask your current customers who they would choose besides you.

- Check Alexa, Google Trends, or SimilarWeb for general estimates on the popularity of domain names and keywords.

- Review Dun & Bradstreet for new incorporations.

- Consult Derwent for new patent information.

- See who has booths at trade shows.

How to Find Potential Competitors

While you consider the current playing field, you must also keep your eye on what’s coming around the corner. These are the future new entrants in your niche. Consider who might start a business that would compete with yours. New competitors can be found in related markets, related technologies, or related products. Companies from other geographical areas with similar products may begin to sell in your area, and former employees or managers can start their own companies based on the themes of your business. In addition, consider the following conditions that may encourage competition:

- A company gains competitive advantage.

- Buyers are dissatisfied with suppliers.

- An unmet demand for goods exists.

- Few major barriers to entry exist.

- The industry offers high profit margins.

- The industry offers unrealized growth potential.

- Competitive rivalry is not intense.

It’s Not All about Competitors ( Competitive Doesn’t Always Mean Competitor )

Depending on what your product or service is and where it is in its life cycle, a competitor focus may not be optimal. For example, for emerging technologies, no true competitor may exist.

“Looking too closely at competition is a massive distraction,” Schechter notes. “If you’re selling a commodity or established product, such as a drugstore, which sells the same thing anywhere, you’d be looking at specific issues, like price, location, and assortment.”

Schecter says marketers themselves often don’t understand that what the competition is doing is not important: “Successful marketing is how you define yourself in the landscape. People don’t care about a feature-by-feature description, or even one feature. They buy the package. They like you. You’re different or you’re solving a particular problem. A new business must define and lay out the landscape for the customer.”

To succeed, understanding what customers want is key. “Marketers have nuanced detail, and customers don’t care about that detail,” Schechter continues. “But, you have to listen to their questions and engage in dialogue with them to gain real understanding,” she points out. She cites Apple’s promotion of the camera in the first iPhone as an example of marketers understanding what — out of thousands of potential functions — was important to consumers. “B2B marketing is the same. It’s about listening to customers, figuring out how they’re shopping, and trying to see through their eyes,” Schechter emphasizes.

“Obsessing over competition can get you off track. If you’re listening to customers, you’ll build the right product. But you don’t need to build your dreams on other people’s ideas,” she concludes.

Where to Find Information for a Competitive Analysis

Remember that every department of your business is a potential source for information, including the following areas:

- Sales: Questions for potential, current, and lost customers

- Research and Development: New patents

- Purchasing: Suppliers

- Marketing: Customers and other consumers

Once you’ve determined who your competitors are and what you want to learn about them and from them, you need to go information hunting:

- Visit offices or brick-and-mortar stores. What do they look like? Who’s there?

- Get financial and organizational information from public filings and from sources like Hoovers, Manta, and Dun & Bradstreet.

- Monitor PR Newswire for new developments and changes.

- Some marketing platforms may actually include information about your competitors.

Interviews and Research Surveys

Interviewing competitor customers and consumers who know little about your business is important to overcoming your preconceptions about the business landscape. You probably have specific questions in mind, but here are the basics:

- Why are you shopping for a solution?

- What were the main reasons you chose the company you did?

- Ranked from most important to least important, what are your five shopping criteria?

Media Scanning or Competitor Content Analysis

You can learn much about competitor products and messaging by scanning media. Media doesn’t just include online content (web pages, tweets, and Facebook posts) — it also includes such traditional marketing collateral as white papers, case studies, and data sheets. Moreover, consider reference materials, such as LexisNexis and Hoovers, and trade, business, or news publications for ads, news stories, and press releases. Media and content can reveal not only new products and new branding, but also new positioning and segmentation strategies, pricing, target markets, and promotion strategy.

What Information to Search for in Competitive Analysis

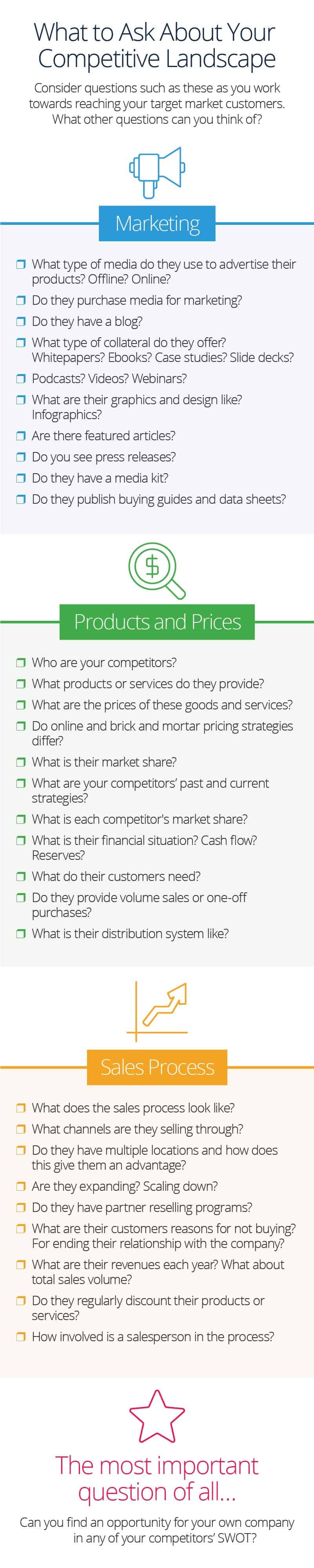

The approach to analysis depends on the questions requiring answers. To organize your analysis, divide it into three aspects: product or services, marketing, and sales. Each aspect contains its own questions and means of analysis.

Products and Services

Your understanding of products and services must be thorough. Investigate the complete product or service line. Try to understand who your competitors’ customers are and what they need. Look at their pricing strategy and see if it differs for online and brick-and-mortar stores. Also, consider how they differentiate from their competitors.

Tracking competitor sales processes can involve more legwork. For public companies, SEC filings provide some financial information about growth or contraction, but, for private companies, information is less readily available. Information about sales channels may be easy to find through a look in the phone book or online. You can also gather details about the sale process by asking current customers why they chose your product over others. You can also acquire valuable information by following up even after you lose a sale in order to understand the customer’s thinking. What do their partner resales programs look like? What are their revenues versus sales volume?

Marketing Efforts in Competitive Analysis

What does the competitor marketing plan entail? How do competitors invest marketing efforts? What can you do even better? A variety of approaches can help you define competitor marketing strategy.

When you identify marketing assets, take a reasonable sample of items — no need to review all of them. Just remember to keep samples consistent among competitors. Also, when reviewing items, consider the quality of the collateral. It should appear professional, with no typos, and in the formal, professional, idiomatic voice. In addition, a solid library of resources, such as consistent blog posts, whitepapers, case studies, videos, webinars, and podcasts may point you to themes and leads you should follow.

E-Marketing Strategy Competitive Analysis

Few businesses today can function without a web presence that helps generate traffic and inquiries or purchases. Some statistics say that prospective buyers visit a website as many as nine times before purchasing and, depending on the product, visit multiple sites before purchasing. Forrester research after 2010 suggests potential customers visit three sites on average before buying. The more sites visited, the more money the customer intends to spend.

Therefore, understanding how your site compares to your nearest competitors can be helpful. To drive eyes to websites, online purveyors use search engine optimization (SEO) to employ the keywords most likely to garner high search ratings in Google (and other search engines). Marketers frequently also use SEM (search engine marketing) to promote a business or product by increasing visits to a website through paid keywords. Look at how saturated their content is with keywords and where they use keywords, whether in H1 and H2 tags, page titles, content, or links. Also, look at the difficulty level of their keywords.

Consider the usability of the steps in the sales funnel as well as the navigation. What do the landing pages say? Also, look at backlinks (i.e., links from other pages to your competitor’s page) to your web page. See how many backlinks exist — and from which pages — to understand if this is something you can improve for your website.

Structure is important, but quality content also matters. Online marketing collateral appears as blogs, white papers, ebooks, case studies or user stories, videos, webinars, podcasts, and more. But words and pictures themselves are not valuable if they don’t offer any unique information or concise approaches to existing knowledge. Check whether content is shared and which topics attract attention, or, conversely, what that content and those topics are linked to. What do readers comment on, if they do comment? Who else is sharing what your competitors are publishing?

Social Media

Certain social media platforms appeal to some audiences more than others. The channels a company favors can reveal clues to the demographics of their target market. Make note of what social media buttons they include on pages and where on the page they include them.

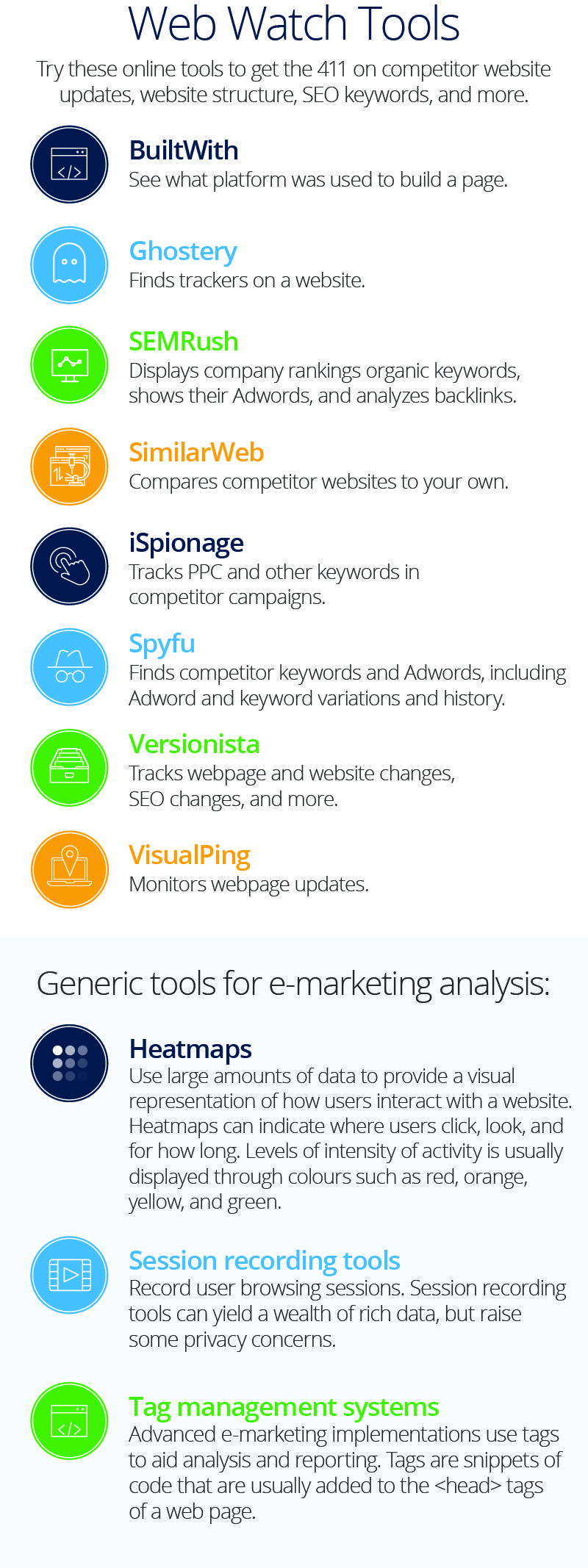

Software Tools for Understanding Online Competitors

Besides monitoring content, you can monitor the mechanics of competitor websites to glean more data about how marketing strategy and product offerings are changing. Software helps to automate these investigations for you. Following are some of the many products available:

- BuiltWith : See what platform was used to build a page.

- Ghostery : Find trackers on a website.

- SEMrush : Discover company rankings, organic keywords, AdWords, and analyses of backlinks.

- Versionista : Track web page and website changes, SEO changes, and more.

- Visualping : Monitor webpage updates.

- SpyFu : Find competitor keywords and AdWords, including AdWord and keyword variations and history.

- iSpionage : Track PPC and other keywords in competitor campaigns.

- SimilarWeb : Compare competitor websites to your own.

- Heatmaps: Use large amounts of data to provide a visual representation of how users interact with a website. Heatmaps can indicate where users click and look and for how long. Levels of intensity of activity are usually displayed through colors.

- Session Recording Tools: Record user browsing sessions. Session recording tools can yield a wealth of rich data, but raise some privacy concerns.

- Tag Management Systems: Advanced e-marketing implementations use tags to aid analysis and reporting. Tags are snippets of code that are usually added to the <head> tags of a web page.

Web Page User Testing for UX in Competitive Analysis

It’s essential to understand how consumers approach your website, especially for web-based products and marketing. Allow customers to test your site, and even view it yourself from a customer’s perspective, to help eliminate unnecessary steps and streamline your sales funnel. Doing so can also help to illuminate the opportunities for upsells and cross-sells.

Limiting the analysis to two or three competitors offers a manageable amount of insight into usability, which helps you avoid reviewer overload and confusion. For impartial results, don’t reveal to test participants which website is yours.

Ask test participants to enter words in Google or list the words and phrases they would use to find a certain product or service. Not only does this yield potentially fruitful keywords, it also indicates whether your site appears in search returns.

To get a sense of each participant’s impression, have them look at each website for five seconds and answer the following questions:

- What three words would you use to describe the site?

- What is it about? What products or services are offered and for whom?

- How does this website make you feel?

To understand their process, give participants a task to perform on each website. Ask them to answer the following questions:

- What was the worst thing about your visit to this website?

- What aspects of the experience could be improved?

- What did you like about the website?

- What other comments do you have?

- Which website did you like best and why?

How Much Data Do You Need in a Competitive Analysis?

It may seem overwhelming to sit down and search out your competitors’ business situations. That’s why setting a clear intention before you begin an analysis is so important. In addition, Babette Bensoussan advises that you don’t need to analyze everything:

“Over the years, I have learned that once you have 70 percent of the information required for your chosen analytical technique, you can proceed to the analysis,” she explains. “You never really need all the pieces of a jigsaw puzzle to tell you what the picture is. This same philosophy applies to analysis. More information may not yield better insights nor improve predictive accuracy.”

How Do I Write a Competitor Analysis Report?

The format of your analysis depends on individual choice and the audience. You may also choose to use one kind of format while you work through the analysis, and another when you present findings.

Take a sheet of paper. In the left-most column, write the names of your closest competitors. Across the top of the page, list the main attributes of each product, such as target market, price, size, method of distribution, extent of customer service, prospective buyers, and so on. Then, make a check or a note for each attribute the competitor fulfils. An additional column can contain information about service or product availability, the website, a toll-free phone number, and other general information.

A competitor profile helps you make a detailed record about each competitor, and also allows you to capture snapshots of a business over time. Consider listing some of the following information:

- Location of offices and factories

- Key personalities, history, and trends

- Ownership, organizational structure, and corporate governance

- Number of employees and skill sets

- Management and management style

- Compensation, benefits, and retention rates

- Plant capacity, utilization rate, age of plant, capital investment

- Product mix per plant and shipping logistics

- Products and services

- Depth of product line

- New products developed and success rate

- Research and development details

- Brands and brand loyalty and awareness

- Patents and licenses

- Quality control conformance

- Cash flow and liquidity

- Profit growth profile

- Method of growth (organic or acquisitive)

- Objectives, mission statement, growth plans, acquisitions

- Marketing strategies

- Segments served, market shares, customer base, growth rate, and customer loyalty

- Promotional mix, promotional budgets, advertising themes, ad agency used, online promotional strategy

- Distribution channels (direct and indirect) and exclusivity agreements

Here is a step-by-step process for writing a competitor analysis report:

- Write down your competitors.

- Write what you know about them already.

- Discover who their target customers are.

- Discover their pricing methods.

- Investigate their marketing strategy.

- Figure out their competitive advantage.

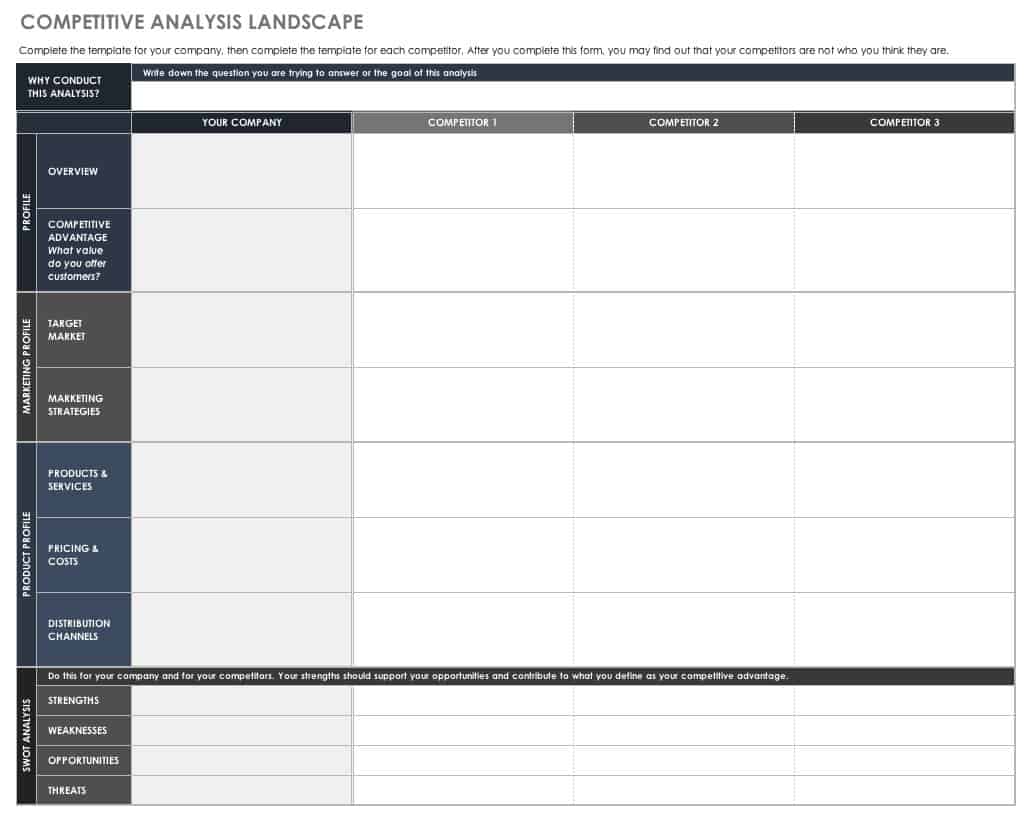

Download our competitive analysis landscape template to get ideas for gathering information and reporting analysis results.

Download Competitive Analysis Landscape Template

Excel | Word | PDF | Smartsheet

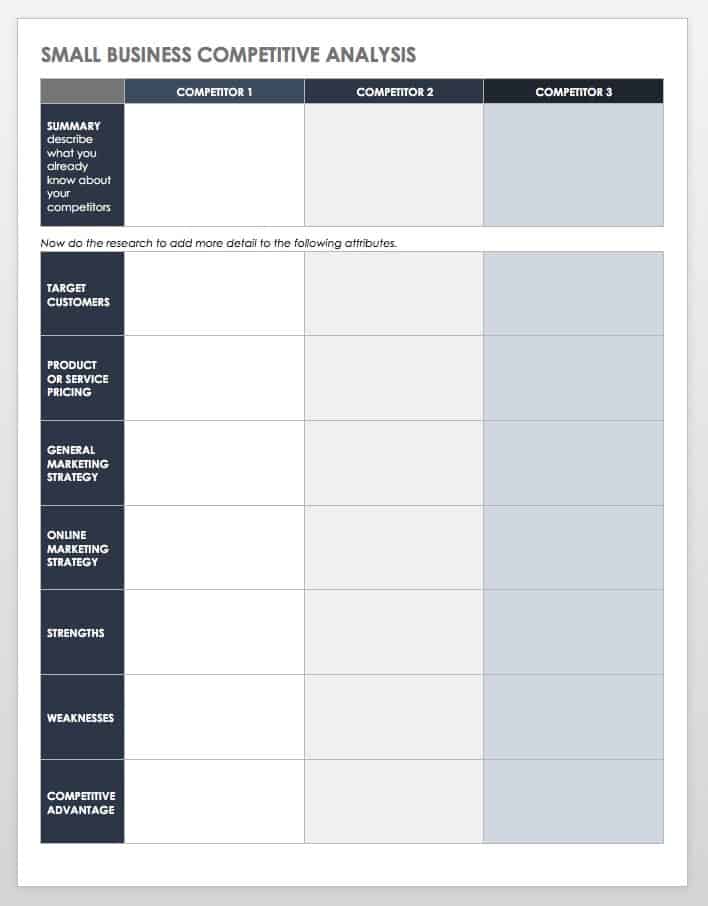

Competitive Analysis for Small Businesses

Small business can be competitive. Beyond meeting financial targets, you need to understand the competitive landscape (short of allowing it to distract you) and then target a niche market. Many of the same analyses that apply to large businesses also apply to small businesses. However, if this is your first business, or if you don’t have a marketing background, you may want to pay attention to a few aspects.

First, it is helpful to acknowledge how much or how little you know about your competitors by sketching a profile of your top two or three competitors. Next, try to learn all you can about your competition.

You can use the following template to perform a competitive analysis for your small business.

Download Small Business Competitive Analysis Template

Word | PDF

What Is a Competitive Analysis in a Business Plan?

Competitive analysis should play a key role in the preparation of a business plan. Particularly if you seek outside funding, your knowledge of the competitive landscape will show your understanding of your business and the market forces at play.

When starting a business, consider all the analysis questions described above, but pay particular attention to issues of growth and opportunity. Consider addressing the following circumstances:

- Whether current competitors target a specific niche or offer products to the mass market

- If, how, and why competitors are growing or reducing business

- How your company will be stronger than competitors and better able to exploit changes in the market landscape

- What you will offer customers that no one else does (your competitive advantage)

In the business plan, describe the competitive landscape as it relates to direct and indirect competitors and opportunities and risks, emphasizing your competitive advantage. This competitive analysis can form the basis for your first marketing plan.

Sharpen Your Competitive Analysis with Smartsheet for Marketing

The best marketing teams know the importance of effective campaign management, consistent creative operations, and powerful event logistics -- and Smartsheet helps you deliver on all three so you can be more effective and achieve more.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Improve your marketing efforts and deliver best-in-class campaigns.

IMAGES

VIDEO